60 billion, the largest IPO in Beijing this year was born

01

It Began With a Cross-Border Acquisition—He Was Called Upon in a Crisis

The story of Etang Semiconductor began with a merger that shook the industry.

In May 2016, in Silicon Valley, the first international merger of Chinese semiconductor equipment was finalized. Under the leadership of Beijing Yizhuang Guotou, Etang Shenglong successfully bought Mattson Technology (MTI), a semiconductor equipment company in Silicon Valley, for a total price of approximately US$300 million. MTI was a supplier of semiconductor wafer etching equipment and one of the well-known integrated circuit manufacturing equipment suppliers at the time.

This acquisition by Yitong not only filled the technological gap in the field of high-end semiconductor equipment in China, but also set a precedent for Chinese capital to cross-border acquire semiconductor equipment companies. Based on this, Yizhuang Guotou established Yitong Semiconductor, and the story slowly unfolded.

However, difficulties soon emerged. After the acquisition, the huge change in equity caused customers to worry about technical security. MTI's orders dropped by 40%, and its revenue in Q4 2016 plummeted to US$103 million (only 60% of the previous year). In addition, the company was facing a crisis moment with executives leaving collectively and cash flow on the verge of breaking.

At that time, Lu Haoan, a senior expert in the semiconductor industry, was appointed. In fact, whether it was this crucial acquisition or the subsequent rise of Yitong Shares, President and CEO Lu Haoan was a key figure.

He is a veritable technical expert. In 1977, Lu Haoan was admitted to the Department of Physics of the University of Science and Technology of China, and later obtained a doctorate in solid-state physics from the University of Virginia. Looking at his resume, he participated in the construction of Intel's Dalian chip factory, led the first chip factory equipment supply chain in Asia, and built SEMICON China into the world's largest semiconductor industry platform.

After taking over the baton of Yitang, Lu Haoan formed a multinational joint team, gradually rebuilding customer trust by retaining MTI's original technical backbone and focusing on research and development. In 2018, Yitang's Beijing Yizhuang factory was completed, and the first domestically produced dry degumming equipment was offline, marking the formation of localized production capacity. Since then, the coverage rate of domestic 12-inch wafer factories has jumped from 15% to 60%, becoming a key force for domestic substitution.

Using Mattson's complete intellectual property rights, Yitang Semiconductor has established a global R&D and manufacturing network to provide relevant equipment and application solutions for global 12-inch wafer factory customers, and its products have successfully entered international cutting-edge production lines such as TSMC and Samsung. In the end, Yitong Semiconductor formed a production layout with Beijing as its headquarters and China, the United States and Germany as its R&D and manufacturing bases, gaining a firm foothold on the international stage.

The horn of listing was blown. In June 2021, Yitong's IPO application was accepted by the Shanghai Stock Exchange Listing Committee, and the listing progress has been delayed since then. According to the prospectus, the actual controller of Yitong Semiconductor is the Financial Audit Bureau, an institution under the Economic Development Zone Management Committee, which holds 100% of the company's shares through Yizhuang Guotou. Yitong Shenglong holds 45.05% of the company's shares and is the direct controlling shareholder of Yitong Shares.

Until today, Beijing state-owned assets finally reaped a super IPO.

02

Annual revenue exceeds 4 billion VC/PE gathers

With the successful IPO, the mystery of Yitong was unveiled.

According to its prospectus, E-Town Semiconductors is a globally operating semiconductor equipment company primarily engaged in the R&D, production, and sales of wafer processing equipment essential for integrated circuit manufacturing. The company has built its technological moat around three core products: dry stripping systems, rapid thermal processing (RTP) systems, and dry etching systems.

Dry stripping systems are used to precisely remove photoresist residues after lithography, preventing chemical contamination that could impair chip performance—a critical factor in production yield. Currently, dry stripping is one of E-Town’s key competitive strengths, positioning the company as a leader in the semiconductor stripping and annealing equipment sector.

The prospectus reveals that in 2023, E-Town Semiconductors ranked second globally in market share for both dry stripping and rapid thermal processing equipment.

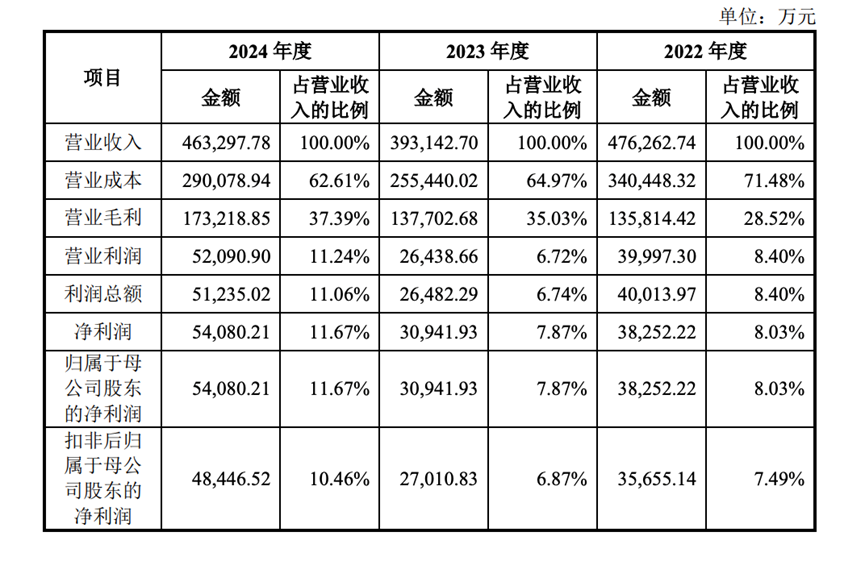

From 2022 to 2024, the company reported revenues of 4.763 billion yuan, 3.931 billion yuan, and 4.633 billion yuan, respectively, with net profits attributable to shareholders reaching 383 million yuan, 310 million yuan, and 540 million yuan over the same period.

Etang Semiconductor has a large customer lineup, such as TSMC, Samsung Electronics, Micron Technology, Intel, SK Hynix, SMIC, Huahong Semiconductor, Yangtze Memory, etc. As of June 2024, the company's products have been installed in more than 4,600 units worldwide.

This was also a phenomenal project in the venture capital circle. In 2020, Etang Semiconductor, which was in the limelight at the time, won three rounds of financing in a row-

In May 2020, in the A round, Haisong Capital, CMB International Capital, Hongdao Investment, Jinpu Investment, etc. participated; in September 2020, in the B round, Oriza Holdings, Shenzhen Capital Group, IDG Capital, Sequoia China, Oriza Hope, Walden International, Huakong Fund, Silk Road Huachuang, Stonebrook Capital, Cornerstone Capital, etc. also came; in October 2020, in the C round, Huangpu River Capital, CPE Yuanfeng, Yizhuang Holdings, China Science Turing, Orange Leaf Investment, etc. were gathered.

In addition to Beijing state-owned assets, before the IPO, Haisong Capital and its affiliates jointly held more than 10% of the shares, making them the second largest institutional shareholder of Yitong Shares; Nanjing Zhaoyin held 3.8%; Hongdao Zhixin held 3.13%; Gongqingcheng Jiansheng held 2.64%; in addition, there are IDG Capital and Sequoia China, CPE Yuanfeng and Shenzhen Capital Group are also on the list.

After years of companionship, the investors behind them finally ushered in the harvest moment.

03

Semiconductor IPO boom is coming

A Telling Sign: The Explosion of Domestic Semiconductor IPOs

As revealed on the official website of the China Securities Regulatory Commission (CSRC) on July 7, ChangXin Memory Technologies (CXMT), China’s leading DRAM chip manufacturer, has initiated its IPO process. Founded in 2016, CXMT completed a 10.8 billion yuan strategic financing round in March 2024, valuing the company at approximately 140 billion yuan**—a true behemoth in the industry.

Another high-profile contender is Unisoc (Shanghai Tangpu). On June 27, Unisoc filed for IPO guidance with the Shanghai Securities Regulatory Bureau, marking its official push for an A-share listing. If successful, it could become China’s first listed smartphone chipmaker. According to the Hurun Global Unicorn Index 2025, Unisoc holds a valuation of 71.5 billion yuan.

Across the board, a legion of semiconductor unicorns is charging toward IPOs.

Recall June 30, when China’s three major stock exchanges accepted IPO applications from 41 companies overnight, including two star semiconductor firms—**Moore Threads and MetaX**, both domestic GPU unicorns.

Born in the same year, 2020, these two companies are dedicated to the independent R&D of full-stack high-performance general-purpose GPU chips and computing platforms. Moore Threads aims to raise 8 billion yuan in its IPO, with a pre-IPO valuation of 24.6 billion yuan, while MetaX’s prospectus reveals a post-investment valuation of 21 billion yuan in its latest funding round.

Shanghai’s semiconductor unicorns are also accelerating. On June 13, **Shanghai Super Silicon**’s IPO application was accepted by the Shanghai Stock Exchange, seeking to raise 4.965 billion yuan. The company, which fills the domestic gap in large-size silicon wafers, has completed seven funding rounds to date, reaching a valuation of 20 billion yuan.

Notably, Shanghai Super Silicon follows Xi’an ESWIN Materials, whose IPO application was accepted by the STAR Market in November last year, as another unprofitable semiconductor company aiming for a public listing.

Quietly, a long queue has formed outside the gates of the A-share market—CanSemi Technology (backed by Guangzhou’s high hopes), chip design firms JLQ Technology and DapuMicro, IC design company OnMicro, and laser chipmaker Dogen, among others. E-Town Semiconductors’ successful IPO is set to create a demonstrative effect.

As is well known, the wave of semiconductor startups that emerged years ago under the push for domestic substitution** has led to an overcrowded field. However, semiconductors are a capital-intensive industry with protracted payback periods. After multiple rounds of frenzied financing, many domestic semiconductor firms now struggle to secure further funding in the private market, leaving numerous companies bleeding cash and barely surviving.

Going public has become a race for survival. Over the past two years, the slowdown in A-share IPO approvals has intensified the pressure. Now, with a long-awaited window of opportunity finally opening, no one can afford to miss it—because missing this chance could mean being wiped out of the game entirely.

This is an exceptionally precious IPO window. And by all indications, everyone is moving faster than ever.