Afraid that the Americans might stop supplying you one day?

1

Which HW "spare tires" have been converted to regular employees?

It is understood that H.W. has increased its investment in HiSilicon to improve its chip self-sufficiency rate in order to "de-Aize" the company. Although it has reached a chip self-sufficiency rate of 70% in

the mobile phone field, it is still highly dependent on the United States for high-end RF, analog chips, FPGAs, and CPUs.

Key components are stocked up in advance, extending inventory cycles from six months to two years.

Since the second half of 2018, Huawei has relaxed supplier certification requirements to accommodate increased shipments.

Huawei has strengthened its domestic supply chain selection and increased its purchasing power from domestic suppliers.

Chen Hua: We systematically reviewed companies in the hardware industry chain, focusing on those with key announcements. In terms of quantity, hardware suppliers are spread across the globe,

with the US leading the pack. Of the 70 core suppliers, 33 are from the US, representing nearly 50%, followed by China with 24. Looking at product categories, hardware is highly dependent on US

manufacturers of chips, integrated circuits, software, and optical communications. Furthermore, hardware is also highly reliant on US software.

A teardown of the H.WP30 phone revealed over 30 components, 14 of which come from H.W. HiSilicon, with the remaining two being unknown domestic parts. While the phone's

core components are still based on European and American chips, H.W. HiSilicon accounts for nearly half of the components, demonstrating H.W.'s self-sufficiency.

In terms of the degree of substitution, some sensors, modulators, and connectors can be fully replaced by domestic suppliers, with representative companies including Tsinghua

Unigroup, Accelink, InnoLight, Unigroup Tongchuang, Luxshare Precision, Everwin Precision, Aerospace Electric, and AVIC Optoelectronics. Some low- and mid-end chips and hard

drives can be partially replaced by domestic suppliers, with representative companies including HiSilicon, Spreadtrum, Hantianxia, Will Semiconductor, and Shengbang

Electronics. However, there are currently no domestic alternatives for verification and testing, some optical components and software, CPUs, GPUs, and databases. Even if

alternatives were found, they would likely be from US suppliers.

2

Opportunities and Challenges in Domestic Chip Localization

What are the opportunities for domestically produced chips to become legitimate? How can we make domestic replacements?

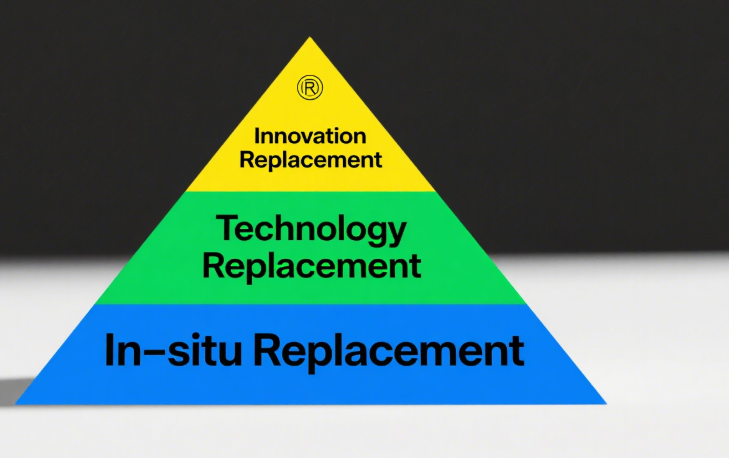

Chen Hua: When it comes to domestically produced chips, there's a certain degree of national sentiment. The path to replacing domestically produced chips can be roughly divided

into three levels: in-situ replacement, technological replacement, and innovative replacement.

In-situ replacement: Maintaining compatibility with the original product's performance, parameters, and packaging, essentially replacing brand A with brand B. This type of

replacement is likely driven by factors like stock-outs and cost reduction, resulting in a relatively short replacement cycle, averaging one to three months. The fastest replacement

I've ever experienced took only one week from sample delivery and testing to order acceptance. This speed is undoubtedly due to our team's accumulated expertise and iterative

experience. Even simple replacements require technical evaluation and supply chain stability testing; otherwise, it would be irresponsible to our customers.

Technical replacement: This type of replacement is more technically challenging than in-situ replacement. It's driven by factors like the inability of the existing device to fully meet

performance requirements or the customer's end-product upgrade. These requirements can also be considered new design-ins, with a consistent approach.

Recently, a company producing optoelectronic products contacted us with a major project. They had originally used a foreign brand of power components and had conducted a

trial run of 1,000 units. During production testing, one defective component was detected. The client engaged two third-party companies to analyze the defect, and the conclusions

converged: this was an atypical issue and a definitive diagnosis was impossible.

The client was eager for a different approach from us, so we worked with Jiejiewei to resolve the issue: five boards in two weeks, and the client was very satisfied. Regarding our

business partnership with this client, we were previously a waiting list, but now we have successfully transitioned to a permanent position.

Technology replacement, on a deeper level, involves providing professional services based on our technological expertise and accumulated experience. We already have numerous

domestic chip partners, and we welcome more chip manufacturers to join us, offering technical services to successfully resolve customer issues.

Innovative replacement: This type of replacement can be said to be the highest level of monster-killing and upgrade, technical services + product upgrade planning. We also happen

to have a typical case. We have a client who makes smart farming products. Their team has over 15 years of experience in the farming industry. When they chose a US brand, they

encountered two problems:

Technical support is lacking because they are still so small.

2.Supply chain instability, including price uncertainty and lead times.

The characteristics of IoT applications are fragmentation, dispersion, complexity and massive demand, which is reflected in the uncertainty of demand in the supply chain.

Customers are worried about the uncertainty of cost and delivery in the supply chain when large-scale demand emerges.

We helped customers make a three-level plan for product advancement:

Reviewing the client's existing supply chain to ensure its stability;

2. Planning domestic substitution for second-generation products, aligning technical feasibility with cost considerations;

3. Assisting the client in preliminary R&D planning for third-generation products, such as chip integration and design optimization.

In fact, when we make innovative replacements, we are more like an old Chinese doctor, for whom observation, listening, questioning and palpation are all essential.

Q: As an engineer with more than ten years of experience, what do you think are the difficulties in domestic replacement?

Lao Mo:

1. Engineer Perception and Risk Assumption

Perception: Currently, many university textbooks use ST as their curriculum. Engineers are accustomed to researching and learning with the technologies they are most familiar

with. When developing projects, they generally choose brands and models with which they are familiar. For example, for small power supply chips in video processing solutions, I

initially chose products from TI and MPS, but now I also choose domestic products such as Shengbang and Weimeng.

Risk: Engineers are risk-averse and try to avoid new brands and models to reduce risk.

2. Scale and Performance

For example, some products have two operating states: standby and active. Domestic chips consume more power in standby mode than foreign ones, and certain performance

parameters of domestic products require further improvement.

3. Support Services

Verification Issues: Engineers often use demo boards for review during development and selection. However, some domestic chips lack development boards and manufacturer

technical support, making it difficult for engineers to communicate effectively with the chip manufacturers.

Q: What are the key paths for domestic replacement of various chip models in European and American industries?

Brother Xin: The term "localization" began gaining traction in 2016. In certain fields, entrepreneurial teams must respect the fundamental logic of business, with key breakthroughs

primarily focused on three directions: (partial) performance optimization, differentiation, and innovation.

One contextual factor cannot be ignored: the higher education of engineers and their long-established workflows are, to varying degrees, influenced by major corporations in

Europe and the U.S. These companies remain the leading players in this field, possessing a relatively mature semiconductor ecosystem.

To some extent, the ongoing trade war has accelerated the upgrade and iteration of domestic chip products. Another critical point to emphasize is the importance of intellectual

property (IP) self-protection. Chinese enterprises must prioritize safeguarding their patents, deliberately circumventing the patent frameworks of Western countries. By exploring

functional replacement technologies in entirely new domains, they can drive the advancement of localized products—creating differentiated and truly innovative solutions.

Q: What are the things worth learning from H.W?

Brother Xin: For H.W., they also expect suppliers to provide higher-performance new products. When evaluating a supplier, H.W. places great emphasis on supply chain security,

even assessing the supplier's secondary supply chain to ensure product reliability from all aspects.

This serves as a reminder to all enterprises in the domestic chip industry: not only must they safeguard their own supply chains, but as part of others' supply chains, they must also

provide security assurances to their partners.

H.W.'s HiSilicon possesses the most advanced domestic chips, and the company will gradually release its cutting-edge technologies to the market. Regardless of U.S. policies, the

industry's development will always adhere to fundamental business logic—delivering better products to users.

Q: H.W. asked TSMC to speed up its move to mainland China. What do you think?

Brother Xin: This is because a responsible enterprise operates with rigorous standards—implementing strict inspection protocols at every stage to minimize uncertainty for

customers and enhance reliability.

[Turning to Sister Hua with a suggestion] By the way, Hua, have you considered potential collaboration with Huawei for your "Chip Superhero" initiative? Perhaps as an authorized

service agent, you could help establish higher verification standards for chip inspections.

Sister Hua: I actually used to supply H.W., mainly providing them with out-of-stock chips. My experience with H.W. was particularly memorable—their standards were

exceptionally high.

When supplying components for their base station projects, even brand-new, factory-sealed chips purchased from authorized international distributors were frequently rejected

for delamination issues—a problem rarely encountered with other telecom equipment makers.

I also recall around 2012-2013 when Broadcom switched from gold to copper wire bonding. H.W. demanded we scour the globe to find remaining gold-bonded inventory...

3

Question and Answer (Q&A)

Hua Jie: How big is the market for domestic replacement chips? Data shows that last year, the amount of imported chips exceeded 300 billion US dollars, and the chip design

industry's sales revenue was 37.8 billion US dollars.

Q: So what breakthroughs and replacements can be made for domestically produced chips? What problems exist? What are the difficulties?

Chen Hua: Currently, domestic replacements are primarily focused on replacing low- and mid-end components. End users need to be more open to supporting domestic

products, and by giving domestic companies time and patience, domestic chips will undoubtedly thrive. We've encountered some end users who believe their existing supply

chain is stable, secure, and controllable. In reality, the definition of supply chain security can be broad or narrow. A broader perspective might be Huawei facing direct bullying

from a powerful nation. For the past decade, Huawei has been preparing and accumulating experience in its supply chain security, but even in this context, external support is still

needed. A more narrow perspective might include occasional natural disasters leading to temporary shortages, or market factors causing unusual price fluctuations. For

businesses, these are all opportunities to consider from a security perspective. Early planning ensures true security.

Lao Mo: The verification cycle is long, from model selection to schematic design, PCB design, prototyping, and testing. The entire process is too lengthy. Our engineers are wary of

taking responsibility. When promoting domestic chips, we pay special attention to which major companies have used them and have proven mass production experience to back

them up.

Question: Brother Xin, as an expert in the field of chip design, in your opinion, how can domestic chips seize opportunities?

Xin Ge: First, Europe and the United States have 50 to 60 years of accumulated experience and are trustworthy. This is determined by the broader environment. However, with the

ongoing trade war, everyone's mindset is shifting. Europeans are considering whether H.W. can provide them with better products, and if so, they're willing to give it a try. This

has also indirectly provided a reassurance for domestic chip manufacturers.

Second, regarding supply chain security, it's crucial to understand the changing mindset of both end users and the supply chain, and think backwards about what kind of

suppliers we're willing to use. Setting our own standards based on those of our partners is beneficial for long-term development.

Finally, business development can be influenced by political factors, and necessary certification and technical preparations must be in place.

Q: A year ago, the ZX incident caused tens of billions in losses. Now, a year has passed. How is ZX doing? What is the difference between the "ZX incident" and the "H.W. incident"?

Let's give encouragement to those who are making domestic chips.

Chen Hua: First, their genes are different: one is a private enterprise, the other a state-owned enterprise. Their driving forces are also different. H.W. has consistently strengthened

its security, supply chain, and core capabilities, and possesses a strong sense of crisis. While Z.T.E. previously had technological advantages, its systems also had some issues, and

it relied heavily on external resources. When faced with bottlenecks, their responses were also different. H.W. was like an invincible cockroach, capable of generating its own

revenue, while Z.T.E. was like a spoiled "aristocrat," with limited self-sustainability.

Among domestic chips, many products are already generating revenue for industry applications, and their technical specifications rival, or even surpass, those of foreign brands.

In the energy Internet of Things sector, which has been quite popular in recent years, one company has dedicated ten years to developing a suite of technologies for electrical

safety applications. This field was previously dominated by foreign giants like Schneider, Siemens, and ABB. Now, with the emergence of new technologies, the landscape is

changing.

Question: Hardware Superman, as a veteran engineer, after the “ZX incident”, what changes do you think have taken place in the market demand for Chinese chips?

Lao Mo: For me, the biggest change among the users I have come into contact with is that many users will actively seek domestic replacement solutions. Secondly, we can find

that in some early video products, such as projectors, laser products, etc., many are made of Japanese or American products. Now companies such as Rockchip and Allwinner can

completely make replacements in this regard. The small tablets and TVs that everyone uses in their lives, etc., the solutions inside them, including SoC, peripheral power

supplies, and amplifiers, are basically all domestically produced, so there is no need to worry about this.

4. Ending

Brother Xin:

Over the past year or so, it has been like a movie—the unfolding of events resembles a grand "drama." I remember back in 2017, when Z.T.E faced its second round of sanctions,

many people were worried. But now, after the "H.W incident," the reaction is different: The more you sanction us, the more motivated and determined we become. The more you

suppress us, the more it proves your fear and our strength. H.W has demonstrated the qualities of an outstanding Chinese company.

H.W's HiSilicon began building its own ecosystem as early as 2004, stockpiling chips even before entering the smartphone business. This shows how essential it is to work

diligently and maintain a sense of crisis. Over the years, the manufacturing industry has been quietly building and striving. I believe that in the coming years, the refinement of

manufacturing will gradually gain recognition from both the public and the government, which will also drive the advancement of the semiconductor industry.

In my view, the current series of events is like an earthquake testing whether our house is sturdy. So far, it has held up well, with no substantial impact on the industry or

performance. Instead, it has made our structural ecosystem healthier. A good supply chain and industry thrive on diversification. I am full of confidence in the future—now, it's

time to "roll up our sleeves and get to work."

Sister Hua:

Now, everyone has given Trump a new nickname—"The Reverse-Motivation Mentor," as he is pushing us to progress. Decades ago, the frontline fighters were workers and

farmers; today, they are engineers.

What if there are short-term supply shortages? We at Chip Heroes can help with matching, as there are still some spot supplies and inventories in the market. Besides, if you have

any needs for domestic alternatives, feel free to reach out to us.