01

Performance is growing

Top 4 Chip Distributors Show Growth in Q2: Arrow and Avnet Gain Momentum

Q2 Revenue Rankings (Highest to Lowest):

WT Microelectronics: $8.7 billion

WPG Holdings: $8.4 billion

Arrow Electronics: $7.6 billion

Avnet: $5.6 billion

WT Microelectronics Leads with Record Performance

In Q2, WT Microelectronics reported consolidated revenue of NT$259.5 billion (approx. $8.7 billion), up 5% QoQ and 7% YoY, exceeding its guidance ceiling of NT$255 billion.

Operating profit reached

NT$4.66 billion, rising 2% QoQ and 9% YoY.

For the first half of 2024, WT’s cumulative revenue hit NT$506.9 billion (≈$16.93 billion), a 16.19% YoY increase, marking an all-time high for the period. Its acquisition of Future Electronics in early

2024 significantly expanded revenue scale, solidifying its position as the industry leader.

Regarding market demand, WT Microelectronics sees continued strong demand for AI, which it expects will drive growth for the group in the second half of the year and into next

year. With the supply chain gradually returning to health and industrial and automotive demand showing a gradual and steady recovery, this will also contribute to the group's

revenue and profit growth. Based on an exchange rate of NT$1 to NT$29.5, WT Microelectronics estimates the median consolidated revenue for the third quarter to be

approximately NT$291.5 billion, a 12% increase quarter-over-quarter and 12% increase year-over-year.

WPG's consolidated revenue in the second quarter of this year reached NT$250.45 billion (approximately US$8.4 billion), its second-highest quarterly performance in history,

exceeding the high end of its financial forecast by NT$220 billion. This represents a 20.4% year-over-year increase and a 0.65% quarter-over-quarter increase. Consolidated revenue

for the first half of this year reached NT$499.29 billion (approximately US$16.68 billion), a 28.1% increase year-over-year.

Notably, WPG successfully surpassed Arrow in the first half of this year, advancing into the top two global chip distributors. You should know that in 2024, WPG was still ranked

behind Arrow. If it continues to maintain this growth momentum in the second half of the year, WPG is expected to officially jump to the second place in the world this year.

Although WT Microelectronics ranked first in revenue in the first half of the year, the gap with second-place WPG was not far. WPG's 28% revenue growth in the first half of the year

surpassed WT Microelectronics' 16% growth, making it even more impressive. However, WT Microelectronics stated earlier this year that it had the potential to surpass NT$1 trillion

in revenue this year, becoming the sixth Taiwanese company to reach this trillion-dollar revenue mark, following Foxconn, TSMC, Quanta Computer, Pegatron, and Wistron.

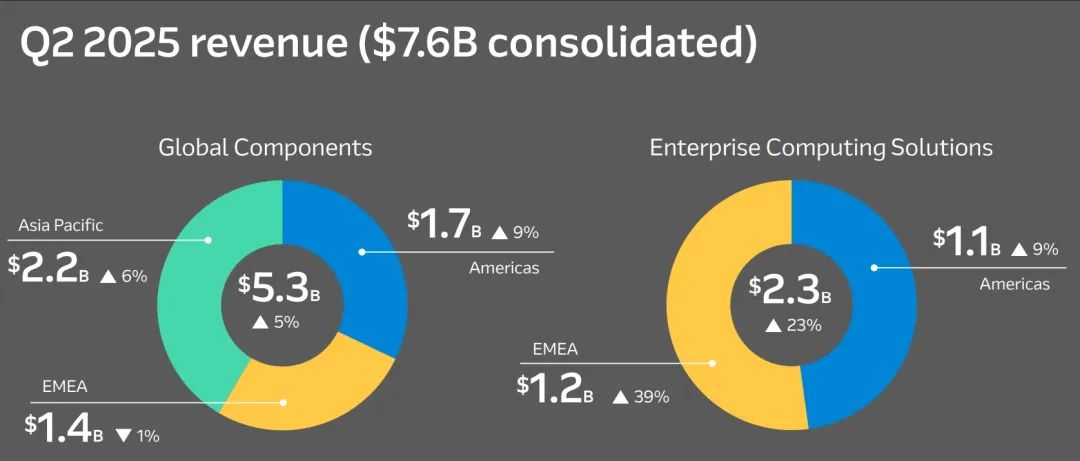

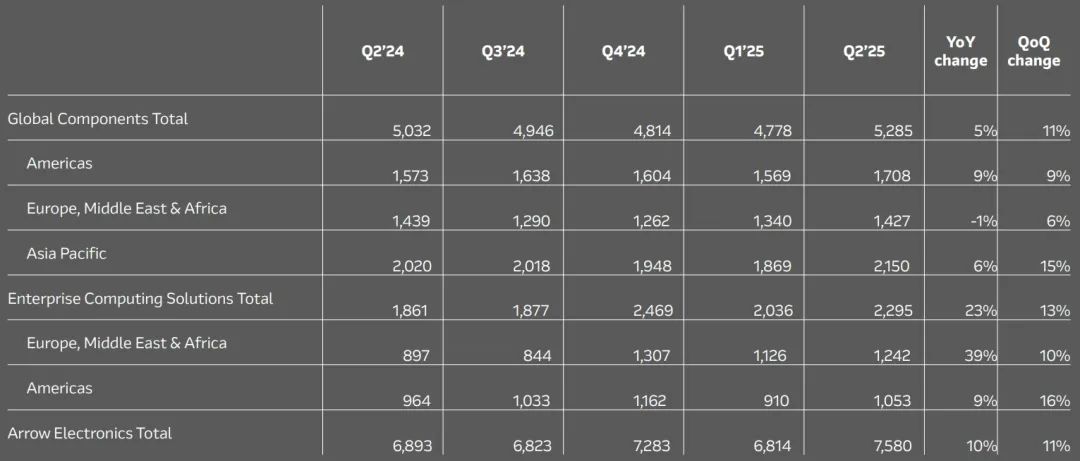

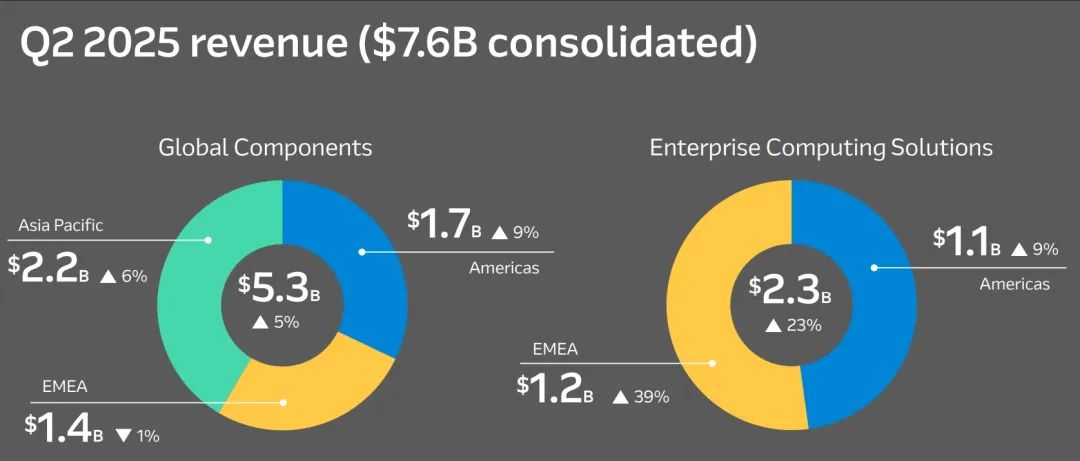

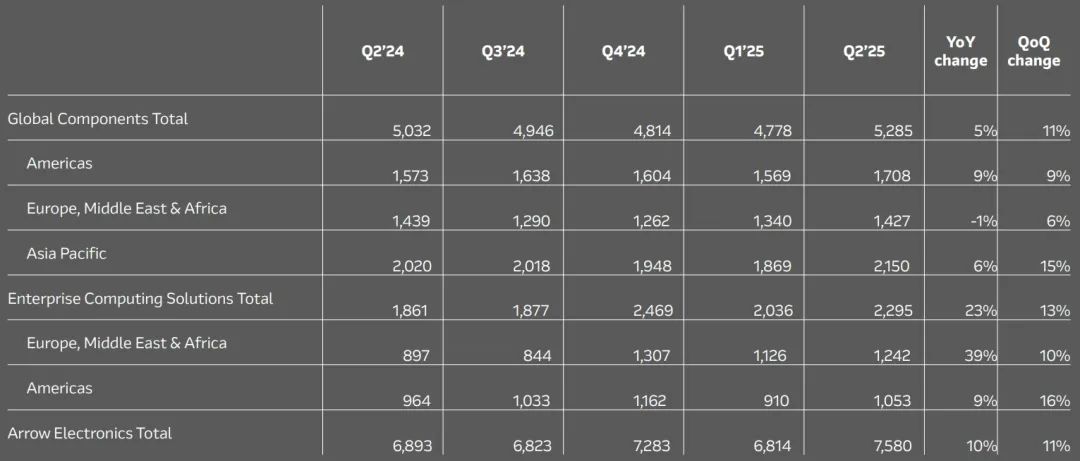

Arrow delivered strong second-quarter results, with consolidated sales reaching US$7.6 billion, a 10% year-on-year increase and approximately 12% quarter-on-quarter growth.

This growth was driven by the first year-on-year increase in global components since 2022 and double-digit growth in Enterprise Computing Solutions (ECS). "I'm pleased to report

that our consolidated and segment revenue, as well as earnings per share, exceeded our guidance range," said Sean Kerins, President and CEO of Arrow. Based on Arrow's US$6.8

billion in first-quarter revenue, its consolidated revenue for the first half of the year was US$14.4 billion. Looking ahead, Arrow expects third-quarter sales between $7.3 billion and

$7.9 billion, with significant contributions expected from its Global Components and ECS divisions. The company provided non-GAAP earnings per share guidance of $2.16 to $2.36,

reflecting a cautious yet optimistic outlook for the next quarter. CEO Sean Kerins expressed confidence in a moderate market recovery and better-than-seasonal sales patterns for

the remainder of the year.

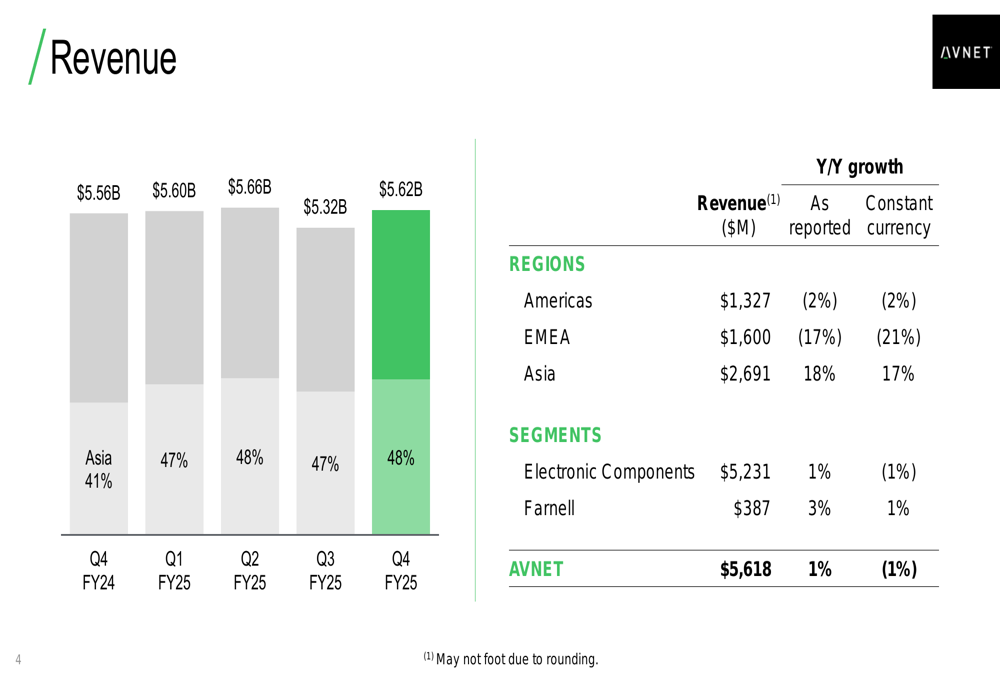

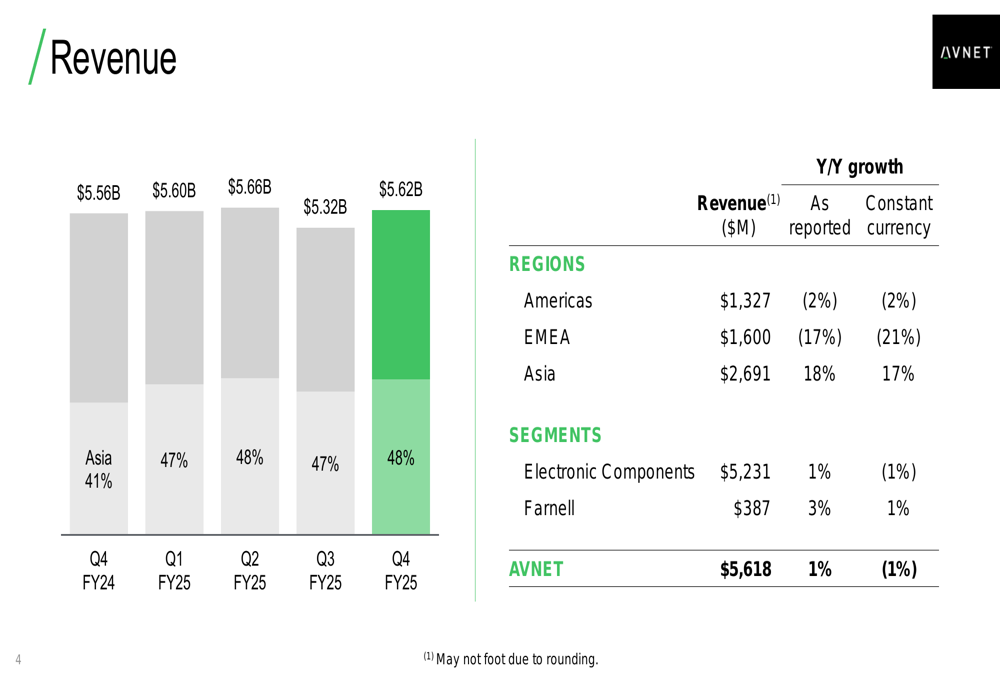

Finally, Avnet's performance showed lower growth compared to the previous three companies.

Avnet's revenue for the fourth fiscal quarter (ending June 28, 2025) rose slightly by 1% year-over-year to $5.62 billion and by 5.7% quarter-over-quarter. Revenue from its electronic

components business grew 1% to $5.23 billion, while Farnell (Avnet's high-service distribution business) saw a 3% increase to $387 million.

Combined with Avnet's third fiscal quarter revenue of $5.32 billion (ending March 29, 2025), this translates to $10.94 billion in revenue for the first half of the year. Avnet CEO Phil

Gallagher said, "We remain optimistic about the recovery, driven by solid growth in Asia and a return to year-over-year growth at Farnell, which will enable us to exceed the high

end of our fourth-quarter sales and earnings guidance. We are encouraged by these positive signals as we begin the new fiscal year."

Looking ahead to the first quarter of fiscal 2026, Avnet provided guidance indicating a slight sequential improvement, with sales expected to be between $5.55 billion and $5.85

billion, with a midpoint of $5.70 billion, representing approximately 2% sequential growth.

2.

Divergent Recovery Paths: WPG Outperforms with Strong Growth

Judging from the regional performance of major distributors, the global market is indeed recovering, albeit at slightly different paces across regions.

Let's first consider Arrow and Avnet, which are lagging behind the "Twin Ws" (WT Microelectronics and WPG) and experiencing a relatively slower recovery.

Arrow's global components business sales (accounting for nearly 70% of the total, with the remainder coming from its ECS enterprise computing solutions business) increased

month-over-month across all regions, driving the components business' first year-over-year growth since 2022.

Arrow's second quarter financial report

In the second quarter of 2025, Arrow's global component sales exceeded the upper end of its guidance range, increasing 5% year-over-year.

Sales in the Americas (representing approximately 32% of the company's total revenue) increased 9% year-over-year, while sales in the EMEA region (representing approximately

26% of the company's total revenue) decreased 1% year-over-year. Sales in the Asia-Pacific region (representing approximately 42% of the company's total revenue) increased 6%

year-over-year. While momentum was particularly strong in Asia, the company achieved sequential growth in all three operating regions. Arrow's leading indicators continue to

suggest a modest cyclical recovery is underway.

Next, Avnet saw strong performance in Asia, leading the way with an 18% year-over-year increase to $2.69 billion. Meanwhile, revenue in EMEA declined sharply, by 17%, to $1.60

billion. Revenue in the Americas fell 2% to $1.33 billion. This regional performance continued the trend from the third quarter, with weakness in EMEA.

Avnet also stated that its book-to-bill ratio improved slightly compared to the previous quarter, with both Asia and EMEA (Europe, Middle East, and Africa) regions exceeding 1,

meaning orders exceeded shipments, a metric that suggests potential for future growth in these two regions.

WT Microelectronics sees that major European and American markets have successfully emerged from the inventory adjustment trough. WT Microelectronics also stated that tariffs

and exchange rate fluctuations created significant uncertainty in the first half of this year, but as the situation becomes clearer, the impact on operations is expected to ease in the

second half of the year.

Notably, WPG experienced faster revenue growth in the first half of this year, further narrowing the gap with WT Microelectronics. WPG's revenue reached NT$499.29 billion in the

first half of the year, while WT Microelectronics' was NT$506.927 billion, a revenue difference of only NT$7.637 billion (approximately US$256 million). In particular, in June, WPG's

revenue continued to grow, while WT Microelectronics showed signs of decline, creating a stark contrast. What are the reasons behind this?

This change may be related to WPG's increased memory business in the first half of the year and WT Microelectronics' loss of ADI's distribution rights.

WPG stated at its first-quarter earnings conference that its PC business saw strong growth in the first quarter, with year-over-year increases in memory. This was primarily due to

price rebounds and the surge in HBM shipments driven by AI servers. Furthermore, the DDR4/5 process transition led to an imbalance in supply and demand.

WPG's June revenue was NT$83.21 billion, a 10.3% increase month-over-month and a 14.9% increase year-over-year. The June performance growth was primarily driven by the

rapid development of generative AI, which drove increased demand for related electronic components such as traditional and AI servers, power supplies, PCs, and notebook

computers. This was also driven by factors such as clients preemptively purchasing goods in response to US tariffs.

WPG, in contrast, saw a significant decline in revenue in June. WT Microelectronics' self-consolidated revenue for June was NT$63.088 billion, a 19% decrease from May and a 17%

decrease year-over-year, marking a 16-month low. Regarding the decrease in June revenue, WT explained that this was due to changes in the shipment rhythm of products that

contribute significantly to its revenue, rather than a decline in demand or market speculation that customers were pulling orders in advance.

Furthermore, the two companies exhibited certain differences in their product mix, which also, to a certain extent, influenced the differing performance and growth rates in the first half of the year.

In the past year, WPG has had a high share in the two application categories of computer peripherals and communication electronics, which were 45% and 23% respectively in the

first quarter.

Source: WPG

source:Wen Ye

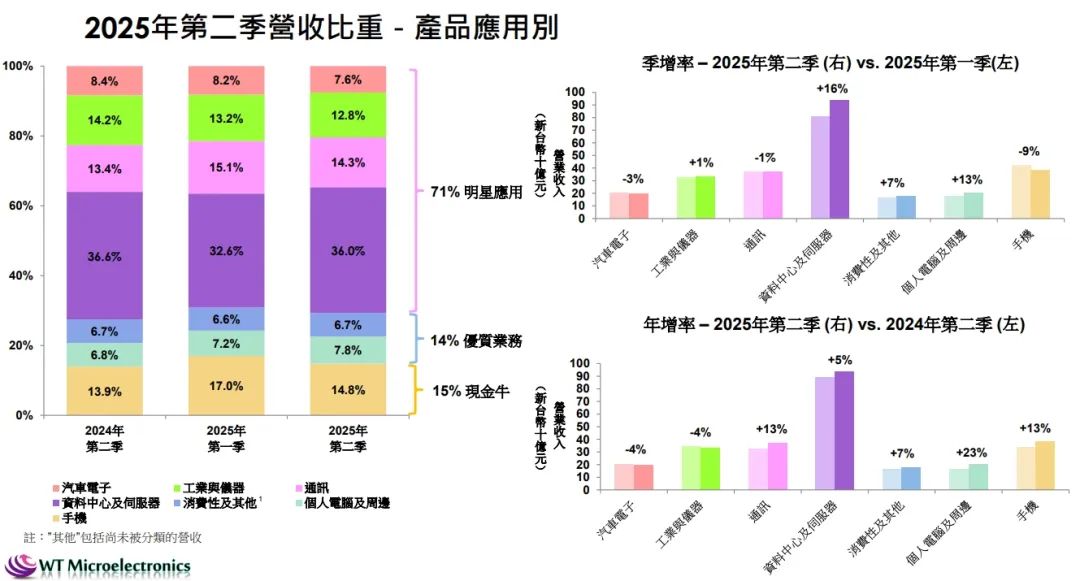

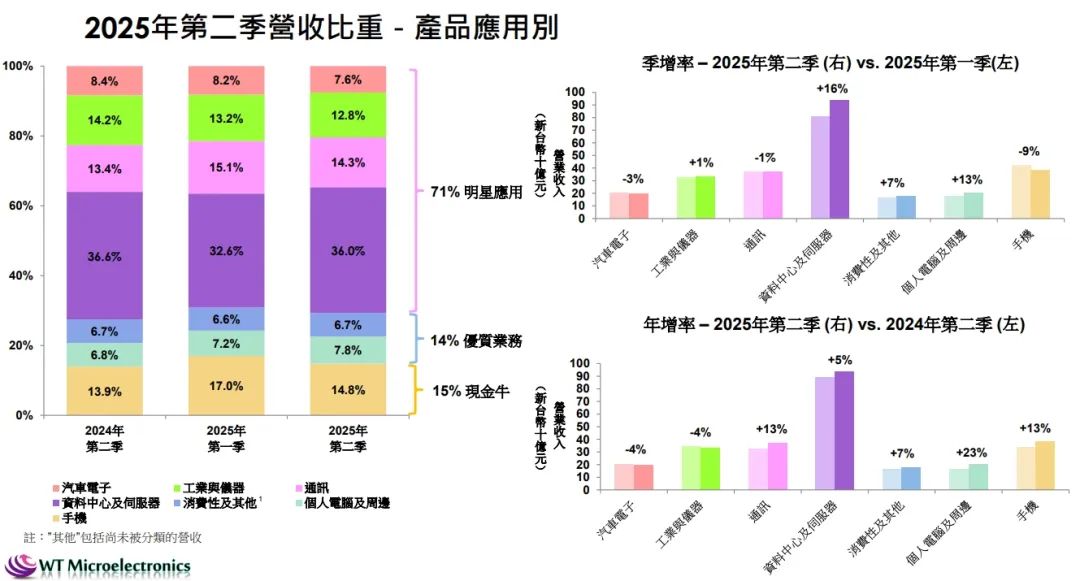

WT Microelectronics recently announced its second-quarter revenue breakdown. Of the top three application categories, approximately 36% were data centers and servers, 14.8%

were mobile phones, and 14.3% were communications. Compared to the first quarter, the share of data centers and servers increased significantly, from 32.6% to 36%, while the

share of mobile phones and communications declined.

03

End Conclusion

According to SIA data, global semiconductor sales reached $179.7 billion in the second quarter of 2025, a 7.8% increase from the previous quarter and a nearly 20% year-on-year

increase. WSTS also released data showing that the global semiconductor market reached $346 billion in the first six months of this year, an 18.9% year-on-year increase.

SIA President and CEO John Neuffer said, "Global chip sales remained strong in the second quarter of this year, increasing by nearly 20% compared to the same period last year. This

year-on-year growth was primarily driven by sales growth in the Asia-Pacific and Americas markets, and we expect the global market to achieve annual growth in the second half of

the year." Overall, despite varying paces of recovery across regions, the global semiconductor market is gradually showing signs of recovery. The performance of the top four chip

distributors continues to improve, and we expect even better performance in the second half of the year.