A ¥17 million order in Huaqiang North ignites the Ethernet chip market.

Some time ago, a "17 million chip order" in Huaqiangbei caused a sensation, attracting the envy and curiosity of peers. Everyone was asking what kind of chip was so expensive, and what kind of chip

could have such a large order in such a flat market?

The details of this 17 million chip order have gradually surfaced, and it's rumored to be Ethernet switch chips from Broadcom. AI and data centers are driving demand for related chips, and after GPUs and HBM, high-end Ethernet switch chips are now on the rise.

01

High-priced, hard-to-get switching chips:

Demand skyrockets.

The 17 million chip order generated significant buzz in Huaqiangbei. Coincidentally, a new chip, the BCM56990B0KFLGG, a Broadcom Ethernet switch chip, became a viral sensation

in March of this year. The price of this chip, the BCM56990B0KFLGG, rose to over $4,000 USD. With large-scale clients seeking large quantities of spot stock, many traders, sensing an

opportunity, began targeting this popular chip, including related models in the BCM56/58 series. However, due to the extremely limited availability of these chips, lead times

exceeding 50 weeks from the original manufacturer, and the limited distribution channels, few could truly capitalize on this type of business.

The 17 million order is rumored to be for the BCM56990 series. This has led some to question the profitability of accepting a 17 million order without inventory and profit. The

distributor reportedly receiving this large order primarily deals with brands like Broadcom, and reportedly said the demand came from overseas customers, allowing them to

capitalize on opportunities within their own market.

Unlike previous years of chip shortages, high-end Ethernet switch chips have exploded in popularity this year. As we've previously written, this chip, like GPUs, has gained

popularity with the recent competition in data centers and large AI models. The BCM56990's popularity has also fueled demand for switch chips like the BCM88790 series.

Broadcom's delivery time remains at 52 weeks, making it difficult to meet these demands.

The strong demand and difficulty in replacing Broadcom's switch chips have fueled their popularity. As the global leader in commercial Ethernet switching chips, Broadcom has a market share of up to 70% (2020 data, excluding Cisco). Its two major product lines, StrataXGS and StrataDNX, constitute Broadcom's strong competitiveness in the data center field.

Broadcom's Ethernet network features an open design and lower costs, and customers are shifting away from exclusive Nvidia suppliers to diversified suppliers. Analysts continue

to believe Broadcom is poised to maintain its market share and advantage. Broadcom's Ethernet switch sales in fiscal 2022 exceeded $200 million in AI applications, a figure

projected to reach $800 million in fiscal 2023 and double to $1.6 billion to $2 billion in fiscal 2024. Furthermore, switch chips enjoy strong customer loyalty and high customer

certification barriers, making them difficult to replace once in use.

Ethernet switch chips are very expensive, ranging from as cheap as $1-20 to as pricey as gold. High-end Ethernet switch chips average over 1,000 yuan per unit, while ultra-high-end

ones can reach tens of thousands of yuan.

For example, the BCM56960 in Broadcom's Tomahawk series (launched in 2014, 3.2Tbps, 400G) currently costs over 10,000 yuan per unit. The prospectus of China's Centec

Communications shows that the average unit sales price of its highest-end TsingMa.MX (2.4Tbps, 400G) series chip product CTC8186 reached about 2,250 yuan during the trial

production stage.

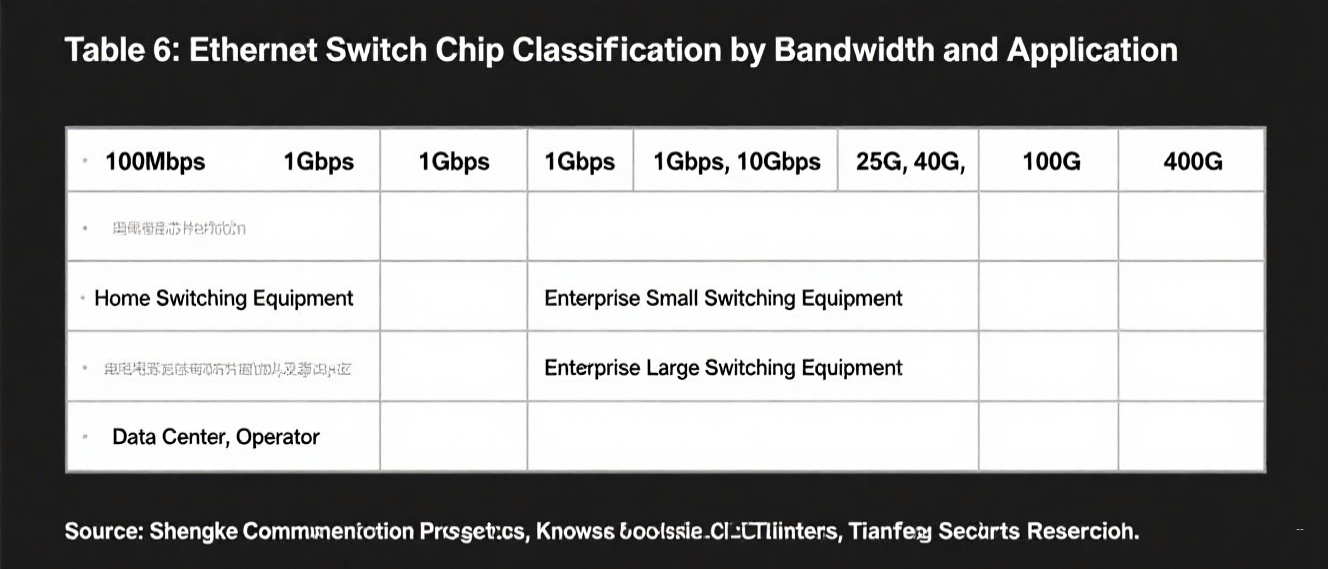

The downstream application scenarios for Ethernet switch chips are categorized into four types: enterprise network Ethernet switching equipment, carrier Ethernet switching

equipment, data center Ethernet switching equipment, and industrial Ethernet switching equipment. Taking data centers as an example, Ethernet switch chips serve as core

components within the switch and determine the utilization rate of the GPU in the server. Only with a sufficiently high-speed and stable network can data centers unleash

theirefficient computing power.

Generally speaking, the higher the bandwidth supported by the switch chip, the wider the application scenarios. In terms of total bandwidth, switch chip products can be

categorized as low-end (100M, 1G, and 10G), mid-range (100Gbps-12.8Tbps), high-end (12.8-51.2Tbps), and ultra-high-end (51.2Tbps and above), with bandwidths ranging from 100M to 51.2Tbps.

Among various application markets, data center applications, which require high-end chips, are the leading growth driver, contributing the majority of growth momentum to

switches. Consequently, high-end switching chips have benefited significantly.

Dell's Oro estimates that the data center switch market will exceed $20 billion by 2025. Lightcounting predicts that the market for high-end switching chips used in data centers is

expected to grow from $270 million in 2021 to $740 million in 2025, with a CAGR of 28.7% from 2021 to 2025. This is driven by the robust growth momentum of data centers driven

by trends in artificial intelligence and digitalization.

02

Switch Chip:

China's 'Little Broadcom' Centec Gains Hot Traction

Broadcom, the global leader in commercial Ethernet switch chips, holds a 70% market share. In my country's commercial Ethernet switch chip market, the three leading vendors,

Broadcom, Marvell, and Realtek, held 61.7%, 20.0%, and 16.1% shares, respectively, in 2020, for a combined market share of 97.8%.

Broadcom holds a significant share in key high-speed Ethernet product applications, such as hyperscale cloud data centers, clusters, and enterprise networks. Marvell's products

are relatively high-end, while Realtek's are more low-end. Beyond commercial Ethernet switch chips, another category is self-developed, primarily by manufacturers like Cisco and

Huawei. These self-developed chips are used in their own switches and are not sold externally.

Along with the booming market for Broadcom's Ethernet switch chips, a domestic Ethernet switch chip company, known as "Little Broadcom," has recently gained popularity:

Centec Communications.

In the commercial Ethernet switch chip market, Centec Communications held a market share of 1.60% (2020), ranking fourth. In this highly competitive commercial market, Centec,

which focuses on mid-to-high-end switch chips, ranks first among mainland Chinese manufacturers, earning it the nickname "China's Little Broadcom."

In 2005, Centec's predecessor, Centec Networks, was officially established in the Suzhou Industrial Park. Its founder, Sun Jianyong, a returnee with a master's degree born in the

1970s, aimed to build a company with independent intellectual property rights capable of developing high-performance routing switches and their core chips, striving to create

world-class chips in China.

Despite nearly two decades of dedicated effort, catching up remains an uphill battle. Currently, Broadcom and Marvell dominate more than 80% of China’s commercial Ethernet

switch chip market. The existing monopoly and barriers remain significant challenges to overcome.

Centec’s core business, Ethernet switch chips, accounted for 64% of its total revenue in 2022, with this proportion increasing year over year in recent years. Its main Ethernet

switch chip products cover switching capacities from 100Gbps to 2.4Tbps and port speeds from 100M to 400G, seeing large-scale application in enterprise networks, carrier

networks, data center networks, and industrial networks.

The company’s mid-to-low-end TsingMa series chips hold a strong competitive advantage. In the high-end segment, particularly in the data center field, Centec has launched

series with switching capacities of 2.4Tbps and 1.2Tbps, which have been adopted by major domestic network equipment manufacturers and achieved mass production. The

TsingMa.MX series chips are supplied to H3C, Ruijie, and Maipu, marking their entry into the supply chains of leading domestic equipment providers.

However, Centec still lags in the ultra-high-end segment. Its Arctic series, designed for hyper-scale data centers with high-performance switching capabilities—featuring a maximum

switching capacity of 25.6Tbps and support for port speeds up to 800G—is expected to be launched in 2024–2025 and is currently in the trial production phase.

Since its establishment in 2005, Centec Communications has focused on independent R&D of Ethernet switch chips. From 2020 to 2022, its R&D investment was RMB 110 million,

RMB 180 million, and RMB 260 million, accounting for 41.97%, 39.61%, and 34.39% of its revenue, respectively. In 2023, this ratio reached 30.28%. However, despite high R&D

investment, the company has reported losses for four consecutive years from 2020 to 2023.

Centec’s revenue has continued to grow in recent years, reflecting broad market prospects. From 2020 to 2022, its revenue was approximately RMB 264 million, RMB 459 million,

and RMB 768 million, with year-on-year growth of 37.59%, 73.91%, and 67.36%, respectively. In 2023, the company achieved revenue of RMB 1.037 billion, an increase of 35.17%

compared to the previous year. Despite this significant revenue growth, the company remained in the red due to substantial R&D expenditures and fluctuations in gross margin.

In 2023, net profit attributable to shareholders was -RMB 19.5308 million.

Switch chips entail extremely high technological and capital barriers. Larger switching capacities and massive logic complexity require significant human resources and tape-out

costs from design to manufacturing. Additionally, an 8–10 year market application cycle and the need for interoperability with computing and storage components from other

vendors impose stringent requirements on the stability and reliability of switch chips.

In 2023, Centec was added to the Entity List, making the need for autonomous and controllable switch chips increasingly urgent. Its single-digit market share in China indicates

considerable room for growth in product competitiveness. Notably, Marvell, Centec’s largest supplier, is also one of its competitors, though Centec has stated that there is no

direct competition between the two.

Besides Centec, other domestic switch chip manufacturers include LongruiXin and Nanfei Micro. LongruiXin’s current highest-end product is the Chunxi SW9004, which offers

200G full-duplex bandwidth and supports port speeds of up to 400G, manufactured using a 28nm process. Nanfei Micro’s top-tier product, the ES8800 series, delivers up to

8.0Tb/s bandwidth per chip, supporting configurations such as 20×400GE, 40×100GE/200GE, or 40×10GE switch ports, and is built on a 7nm process.

03

Rapid Growth:

Opportunities and Challenges Coexist

The rapid growth of the global switch market is driving an increase in the switch chip market, with China's switch chip market experiencing significantly higher growth than the

global average. Public data indicates that the global Ethernet switch chip market is expected to reach 43.4 billion yuan in 2025, with a compound annual growth rate (CAGR) of

3.4% from 2020 to 2025. CSI Consulting predicts that China's switch chip market will reach 22.5 billion yuan in 2025, with a CAGR of approximately 13%.

AI computing infrastructure is driven by three pillars: optical modules, servers, and switches. Switch chips, the brains of switches, see their bandwidth double approximately every

two years, continuing Moore's Law. Demand for high-port-rate Ethernet switch chips is rapidly growing, and with the surge in data center demand, a race for chip performance

has begun.

The investment cost of a single switch chip can easily reach tens of millions of yuan, with costs directly proportional to switching capacity. This involves the following formula:

chip switching capacity = single-port rate * number of ports.

Switching capacity represents the total data exchange capability of a switch, measured in Gbps. Higher capacity indicates greater data processing capabilities but also higher design costs. Single-port speed refers to the maximum number of bits transmitted per second per port; higher numbers indicate higher performance. High-speed data centers typically require switches that support 128 200G or 64 400G ports.

Currently, 400G speeds are becoming a trend in data centers. As server speeds increase from 10G to 100G, switch speeds are correspondingly increased to 400G (4 x 100G) to

support port disaggregation.

Switching chip speeds will continue to increase in the future. According to data from Dell'Oro cited in Arista's Q2 2023 earnings conference, 800G switching chips will begin to

enter mass production in 2023, and by 2025, the market size of 800G switching chips will surpass that of 100G/400G switching chips, becoming the mainstream product in data

centers. By 2025, data center, enterprise network, carrier, and industrial applications are expected to account for 70.2%, 20.7%, 7.8%, and 1.3%, respectively.

Currently, 51.2T switching capacity is the industry's ceiling. Four manufacturers have released 51.2T switching chips: Broadcom, Cisco, Marvell, and Nvidia.

Broadcom, the global leader in commercial Ethernet switch chips, launched the Tomahawk 5 in 2022, making it the first commercially available switch chip with 51.2 Tbps

bandwidth. The Tomahawk 5 supports 64×800 G ports or 128×400 G ports, doubling the data switching performance of its predecessor, the Tomahawk 4, and is manufactured

using a 5nm process.

Marvell, the second-largest player in the commercial switch chip market after Broadcom, is capitalizing on the AI boom alongside NVIDIA and Broadcom. The company is now

directly competing with Broadcom, having achieved mass production of its 12.8 T switch chip products. Marvell stated that its R&D investment in data center switching has

increased by 2.5 times, and its Teralynx 10—a 51.2 T product evolved from Innovium—has entered mass production. Some analysts note that Marvell’s roadmap in switching is

gaining more traction compared to Broadcom’s Tomahawk and Jericho series.

NVIDIA’s Spectrum-4, designed for Ethernet networking, also features a "51.2 T + 800 G" configuration. Unlike Broadcom and Marvell, however, NVIDIA does not sell this chip

externally. Launched in 2022, the Spectrum-4 is the world’s first 400 Gbps end-to-end networking platform, delivering 51.2 Tbps of single-chip switching throughput—four times

that of its previous generation. It offers ultra-high network performance and robust security for large-scale data center infrastructures and is built on a 4nm process. For

InfiniBand networking, NVIDIA announced that its Quantum platform will be upgraded to 800 G in 2024.

To build a fully integrated ecosystem, NVIDIA acquired Mellanox in 2019 and Cumulus Networks in 2020, creating a powerful trifecta in the global Ethernet market. However, recent

reports suggest that OpenAI is leaning toward adopting Ethernet over NVIDIA’s InfiniBand, aiming to reduce its dependency on NVIDIA.

In summary, the ongoing push for higher switching capacity and performance is turning the switch chip market into a capital-intensive battleground.

This rapid market growth and relentless technological advancement by industry giants present both opportunities and challenges for China’s domestic switch chip

development. Switch chips account for over 40% of the total cost of a switch, yet China remains heavily reliant on imports, with a low rate of domestic production. Established

leaders like Broadcom benefit from decades of technological and market expertise, as well as strong customer loyalty. Chinese chip companies still face a significant gap,

compounded by high investment risks, necessitating long-term strategic development. Only by committing to sustained effort and gradual accumulation of experience and

capabilities can local players hope to gain a foothold in this fiercely competitive global arena.

2025-08-22