Broadcom Soars 261% in Two Years, Surging All the Way

Indeed, from a chip company's perspective, Broadcom has every reason to rise. As one of the biggest beneficiaries of the generative AI boom, Broadcom's hyperscale data center customers are looking for alternatives to pricier Nvidia chips. Broadcom helps design custom AI chips. This year, Broadcom launched its Tomahawk Ultra networking chip and next-generation Jericho networking chip to accelerate AI computing, part of its efforts to challenge Nvidia's dominance in the AI semiconductor industry.

Emarketer analyst Jacob Bourne said, "As large tech companies compete to advance model training and inference, Broadcom's custom products for cloud computing giants are well-positioned." He added, "While Nvidia's GPUs remain the default choice, custom silicon can deliver niche performance gains and help overcome bottlenecks."

Based on recent financial data, Broadcom appears to be doing a good job.

Won $10 billion in AI chip orders.

Driven by insatiable customer demand for artificial intelligence chips, Broadcom's latest financial results once again exceeded expectations.

According to the company's financial data, third-quarter earnings (excluding certain costs such as stock-based compensation) were $1.69 per share, slightly exceeding Wall Street's

expectations of $1.65. Revenue for the quarter reached $15.96 billion, up 22%, exceeding the expected $15.83 billion.

The strong performance helped boost Broadcom's earnings. The company reported a net profit of $4.14 billion for the quarter, up from a $1.88 billion loss in the same period last

year. The loss in the same period last year was due to a one-time $4.5 billion tax charge related to the transfer of intellectual property to the United States.

Broadcom CEO Hock Tan noted that the company achieved record third-quarter revenue, driven by growth in customized AI accelerators, network infrastructure, and VMware. "AI revenue grew 63% year-over-year," said Tan. "We expect AI semiconductor revenue to accelerate in the fourth quarter, marking our 11th consecutive quarter of growth as customers

continue to invest heavily."

Broadcom forecast fourth-quarter sales of $17.4 billion, topping Wall Street expectations of $17.02 billion. The company's shares rose more than 3% in after-hours trading, having

also risen 1% earlier in the session.

Zacks Investment Research analyst Kevin Cook said Broadcom shareholders have become accustomed to earnings beats and upward revisions. "The earnings beat wasn't huge, but

the guidance increase was large enough to send the stock briefly soaring to an all-time high near $320," he said.

Broadcom specializes in designing custom chips for hyperscale cloud infrastructure providers like Google, as well as the networking components and software needed to connect

thousands of chips together into large clusters for artificial intelligence processing.

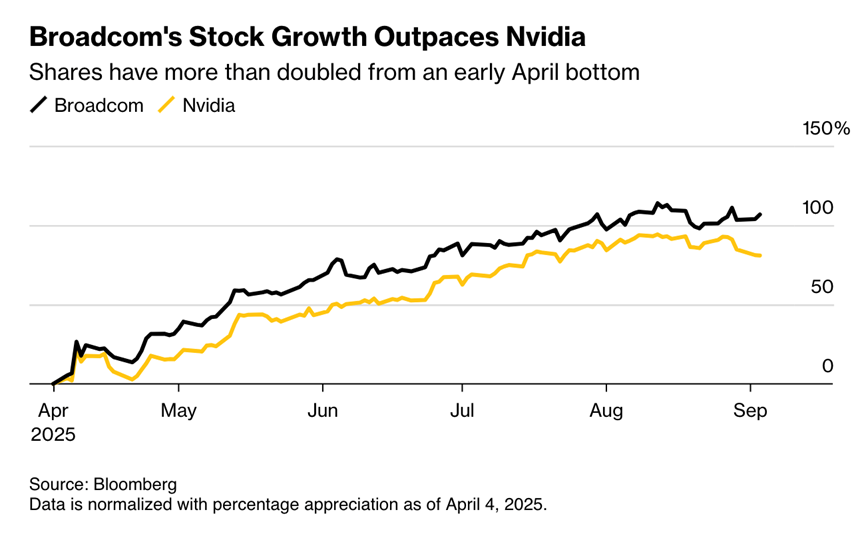

The company has emerged as one of Nvidia's main competitors this year, with its stock price up 32% year-to-date and a market capitalization exceeding $1.4 trillion. Investors are

optimistic that Broadcom can increase its share of the AI chip market as cloud operators increasingly purchase Broadcom's client processors to replace Nvidia's graphics processing

units (GPUs), which currently power most AI workloads. In March, Hock Tan revealed that Broadcom was working with three large cloud customers on new AI chips, further

bolstering investor optimism.

Broadcom said its semiconductor solutions business, which includes sales of AI chips and other processors, saw revenue grow 57% to $9.17 billion in the latest quarter. Meanwhile, revenue from its infrastructure solutions business, which includes networking hardware and VMware, grew 43% to $6.79 billion.

On a conference call with analysts today, Hock Tan said AI revenue grew 63% this quarter to $5.2 billion, exceeding the company's previous forecast of $5.1 billion. He expects AI

revenue to soar to over $6.2 billion in the third quarter.

However, Tan saved the best news for last, revealing on the call that the company had just secured a $10 billion order for custom AI chips (XPUs) from a fourth, undisclosed

customer. As a result, the company raised its AI revenue forecast for fiscal 2026. "One of the potential customers has placed a production order with Broadcom, so we have qualified

them as an XPU customer," Tan told analysts. "We will see quite strong shipments starting in 2026."

Cook said the announcement confirms that AI infrastructure will continue to grow strongly in the new year. He also praised Broadcom as an "early leader" in custom chips for

hyperscale cloud service providers and contrasted its success with the struggles of rival chipmaker Marvell Technology Inc., which has struggled to achieve similar momentum.

"I've always considered AMD a strong second-best in GPU-powered AI, especially at less than 8 times sales," Cook said. "But Broadcom's growth in custom XPUs is so strong that it

could command a P/E of 22 times, at least for the next few quarters."

How to break through Nvidia’s moat?

While Broadcom's performance appears impressive, breaking through Nvidia's defensive moat is crucial for Broadcom's ability to advance further.

As mentioned above, Broadcom dominates the AI ASIC design market. Google, Meta, and ByteDance are its top three customers, with Google's Tensor Processing Unit (TPU) project

contributing the majority of its revenue. The TPU, now in its seventh generation, powers Google's flagship Gemini large-scale language model, which no longer relies on Nvidia

GPUs. Google's capital expenditures for this year have been revised upwards several times, currently projected to reach $85 billion, a 61% year-over-year increase. Coincidentally,

Broadcom projects its AI semiconductor business, which includes ASICs and data center networking chips, to grow 60% this year.

Even more remarkably, Tan told analysts in June that he expects this momentum to continue, projecting another 60% increase by 2026. This prediction caused a stir among

analysts, who generally expect a significant slowdown in global AI capital spending next year.

Can Broadcom really sustain such rapid expansion? Does this mean it's eating into Nvidia's GPU market share?

During Nvidia's latest earnings call, an analyst pointedly asked whether Broadcom's projected 60% growth signaled a broader shift from GPUs to ASICs.

Huang didn't directly answer. Instead, he launched into a lengthy critique of the ASIC model, claiming that many have attempted to develop AI ASICs, but most have failed to achieve mass production because they're simply too difficult. He argued that AI is advancing too rapidly—with breakthroughs in diffuse models, multimodal architectures, and

other technologies occurring so quickly—that custom chips risk becoming obsolete before they even reach scale.

Joseph Moore of Morgan Stanley agreed, noting that dozens of startups (even Intel and AMD) have tried and failed to displace Nvidia since 2018, despite the company investing over

$10 billion annually in R&D. Some Nvidia insiders were even more dismissive, arguing that hyperscalers were primarily using the ASIC project as leverage to negotiate GPU prices.

However, this time, Broadcom's progress is different. Moore pointed out that Broadcom has historically been very conservative in disclosing customer developments, only listing a

company as a "customer" once it has generated substantial revenue.

Looking back, Huang Renxun's second argument against ASICs was that AI data centers are not just about competition between chips but a "full-stack" battle—including

networking technology, especially Nvidia’s proprietary NVLink, which he called "completely revolutionary." Anyone who watched Huang Renxun’s GTC keynote earlier this year

would have learned two new key terms:

Scale-out: Refers to connections between racks within a data center, a market currently dominated by Broadcom’s Ethernet switch chips.

Scale-up: Refers to connections between tens or hundreds of GPUs (or AI ASICs) within a single rack, a domain dominated by Nvidia’s NVLink switches.

NVLink, along with CUDA, is considered one of Nvidia’s two core moats. The emergence of NVLink has enabled Nvidia to bundle GPUs with switches, solidifying its dominance in

rack-level AI networking.

For Broadcom, long regarded as the king of networking, this was unacceptable. In July this year, Broadcom fought back by launching the Tomahawk Ultra chip—a 5-nanometer

Ethernet switch chip designed to outperform NVLink in low-latency workloads.

As for CUDA, it is a challenge being tackled jointly by Broadcom’s customers and partners.

Broadcom, can it continue to be crazy?

Investors are optimistic that the company's custom processors could threaten Nvidia's dominance in the artificial intelligence chip market in the coming years. In March, Broadcom

CEO Hock Tan stated that the company is working with its three major cloud customers on new AI chips and expects AI growth to continue into next year.

Bloomberg reported in a recent article that the Philadelphia Stock Exchange Semiconductor Index has fallen more than 3% since Nvidia's earnings report, while the tech-heavy

Nasdaq 100 Index has fallen less than 1%. Arm Holdings Plc has fallen more than 4%, while Advanced Micro Devices Inc. has fallen about 3.5%.

Given the increasingly high barriers to entry in this market, it's not surprising that Broadcom's stock price declined (at least in the short term) after the after-hours earnings report.

"Given that Broadcom has already indicated a 60% growth in its AI revenue for next year, it may be challenging for the company to raise expectations further during this earnings

call," wrote Ben Reitzes of Melius Research in a September 2 report to clients, while raising his price target from $305 to $335. "However, the company appears to be going all out,

and we would view any weakness in the stock as a buying opportunity, as there is a lack of this type of leader in the AI space aside from Nvidia."

Of course, Broadcom's stock may avoid the fate of Nvidia and Marvell. The company has less exposure to the Chinese market compared to Nvidia, and it has demonstrated the

ability to capture spending from large tech companies building their own AI infrastructure.

"Marvell's data center revenue clearly fell short of expectations, which somewhat indicates that market competition remains fierce, and we are starting to see winners and losers,"

said Brian Mulberry, client portfolio manager at Zacks Investment Management. "The focus will shift more toward companies that are truly seeing returns on investment, such as

Broadcom."

What are your thoughts on Broadcom's future market performance?