Silicon Labs chips, why are they in short supply recently?

01

MCU shortage and price increase, demand heats up

Several distributors specializing in Silicon Labs products indicated that certain models from the company are indeed experiencing "minor shortages." Demand began gradually increasing in April this year, with prices rising slightly before stabilizing. However, by July, the market had noticeably heated up. That said, not all products are in short supply—this current wave is primarily related to applications in the drone industry.

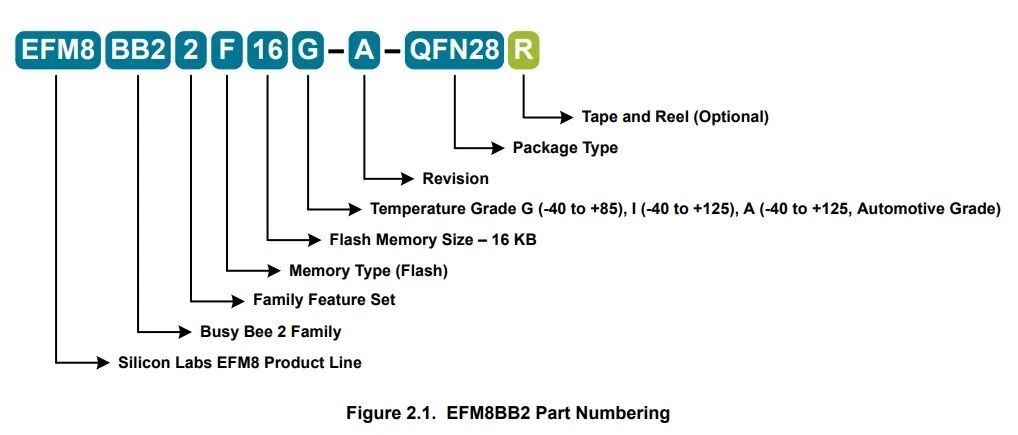

The main drivers of this market trend are Silicon Labs’ electronic speed control (ESC) MCU chips, mainly from the EFM8 BB5 and EFM8 BB2 series. Additionally, the company’s IoT SoCs, such as the EFR32MG21 series, are also gaining traction.

Popular EFM8 models currently in high demand include the EFM8BB51F16G-C-QFN20R and EFM8BB21F16G-C-QFN20R, among others. Some models have even seen prices double—for instance, the EFM8BB51F16G-C-QFN20R has risen from around ¥3 to approximately ¥6.

The EFM8 BB (Busy Bee) series belongs to Silicon Labs' family of 8-bit general-purpose MCUs, known for their compact size and versatile functionality.

Among them, the EFM8BB51 is based on a wide-voltage 8051 platform with a operating frequency of 50MHz. It is commonly used in applications such as home appliances, toys, battery packs, and

optical modules. On the other hand, the EFM8BB21 is designed for low-power applications, also running at 50MHz. It is well-suited for motor control, consumer electronics, sensors, high-speed

communication hubs, medical devices, and lighting systems.

(Sleepy Bee) series, the EFM8 LB (Laser Bee) series known for its high-precision analog capabilities, and the EFM8 UB (Universal Bee) series designed as compact, low-power USB

microcontrollers. Together, these form a comprehensive portfolio for Silicon Labs' EFM8 series MCUs.

These chips are primarily used in drone ESCs (Electronic Speed Controllers), where the main MCU serves as the core component of the ESC. It drives the motor, adjusts rotational

speed, and ensures stable flight performance for the drone.

According to an international FPV drone platform, commonly used MCUs in multi-rotor ESCs include those from ATMEL, Silicon Labs, and those based on the ARM Cortex

architecture. The overall performance ratings for relevant 8-bit MCUs (from best to worst) are: BB5/BB2 > BB1 > F39X > F330 > Atmel 8-bit.

In comparison, Silicon Labs’ Busy Bee series supports hardware PWM and the DShot ESC protocol, delivering smoother throttle response. Ranked among the top performers in the

8-bit MCU category, it offers a cost-effective solution and has thus become a popular choice for drone ESCs.

Some distributors have indicated that the earliest batch of Silicon Labs’ out-of-stock chips is expected to arrive in September, and the shortage is likely to gradually ease.

Others mentioned that, based on their understanding, the normal lead time is around 8–12 weeks, so if shipments do arrive in September, it would be considered relatively early.

According to inquiries on several distribution platforms, the official lead time for the EFM8BB51F16G-C-QFN20R is currently around 16 weeks. Orders placed now are expected to ship by the end of December.

As for the EFM8BB21F16G-C-QFN20R, the manufacturer’s lead time has reached 20 weeks, meaning orders placed today likely won’t arrive until January next year. Inventory is nearly depleted.

Silicon Labs’ major authorized distributors include Arrow, EDOM Technology, Mouser, WT Microelectronics, Element14, RS Components, Alcom Electronics, and SECO, among others. Among them, Arrow and EDOM together account for approximately 43% of the company's revenue.

The current tight supply and price increases affecting specific models are primarily driven by limited availability in the spot market, combined with influences from artificial factors such as stockpiling and speculative purchases.

Overall, the current shortage is not widespread across all product lines. With subsequent replenishment of certain devices, the supply situation is expected to gradually improve.

2.

With Performance Rebounding, Company Sets Sights on Vast Trillion-Yuan IoT Market

Silicon Labs (Silicon Labs), founded in 1996, is a fabless analog chip company specializing in low-power wireless connectivity and providing analog-intensive mixed-signal solutions for a wide range of electronic products in the IoT sector. Its chip manufacturing currently relies primarily on foundries such as TSMC and SMIC.

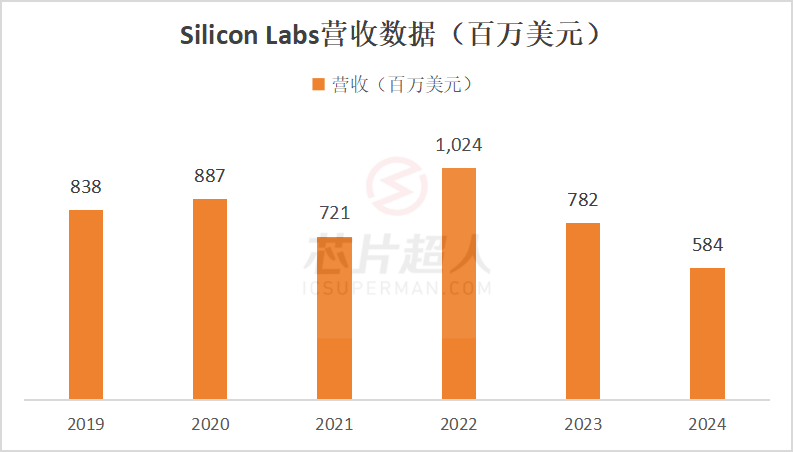

In terms of scale, Silicon Labs is relatively small, with 2024 revenue reaching $584 million. Distribution channels accounted for 67% of sales, while direct sales made up the remaining 33%. Notably, 90% of its 2024 revenue came from outside the United States, with approximately 15% originating from the Chinese market.

According to the company, Silicon Labs continues to expand its product portfolio through a dual strategy of organic growth and acquisitions, introducing innovative products and solutions. Due to significant investments in customer design processes, its products have a relatively long lifecycle. Revenue in fiscal years 2024, 2023, and 2022 was primarily driven by sales of mixed-signal products.

Looking back over recent years, Silicon Labs exceeded $1 billion in revenue in 2022. However, as the industry entered a downturn, its performance gradually came under pressure. By 2024, revenue had declined to $584 million, falling short of the $720 million achieved in 2021. Gross margins from 2022 to 2024 were 64.3%, 58.9%, and 53.4%, respectively, showing a downward trend.

Compared to the previous year, both product sales volume and average selling price (ASP) of Silicon Labs declined in 2024. Due to customers’ ongoing efforts to reduce inventory—originally built up in response to supply chain disruptions during the 2021–2022 fiscal years—the weak demand that emerged in the second half of 2023 continued into fiscal year 2024.

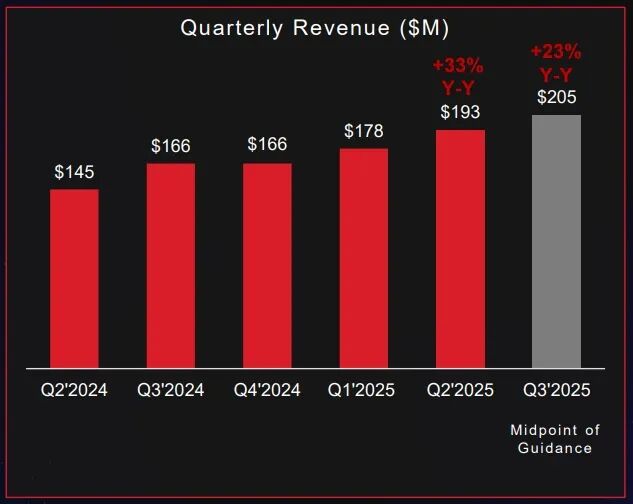

However, by the end of 2024, conditions began to improve. Revenue increased by more than 90% compared to the low point in the fourth quarter of 2023, driven by a gradual reduction in excess customer inventory, sustained improvement in order intake, and market share gains in certain segments. In the second quarter of 2025, the company reported revenue of $193 million, up 33% year-over-year and 9% sequentially, marking the fourth consecutive quarter that results exceeded market expectations.

From a business structure perspective, Silicon Labs operates primarily in two segments: Industrial & Commercial (accounting for 58% of revenue) and Home & Life (42%).

In the second quarter of this year, revenue from the Industrial & Commercial segment grew 25% year-over-year, while the Home & Life segment performed even more strongly with a 45% year-over-year increase, supported by continued expansion in smart home, healthcare, and industrial applications. Inventory levels also improved, with days of inventory dropping to 86 days in Q2, down from 94 days in the first quarter.

Looking ahead, Silicon Labs expects its Q3 2025 revenue to reach between $200 million and $210 million, representing a year-over-year increase of 23%. Analysts project that the

company’s full-year revenue for fiscal 2025 will see robust growth of 35%, with gross margin expected to improve to 57%–58%. The company anticipates that its performance will outpace the broader semiconductor market, supported by a significant increase in customer demand.

It is worth highlighting that Silicon Labs has made decisive strategic choices—shedding non-core operations and fully embracing the Internet of Things (IoT).

As early as 2012, the company clearly identified IoT as its strategic focus. Through a series of acquisitions between 2012 and 2020, it consistently expanded its IoT hardware and software product portfolio, building a comprehensive IoT ecosystem.

In 2021, Silicon Labs sold its Infrastructure & Automotive (IA) business—including power, isolation, timing, and broadcast products—to Skyworks for $2.75 billion. This segment had generated $375 million in revenue in fiscal 2020, accounting for approximately 42.3% of the company’s total revenue at the time.

By divesting the declining IA business, Silicon Labs completed its transformation into a pure-play IoT connectivity provider. In 2021, the company set a goal for its IoT products and technologies to adress a total market opportunity of $10 billion (as of 2023).

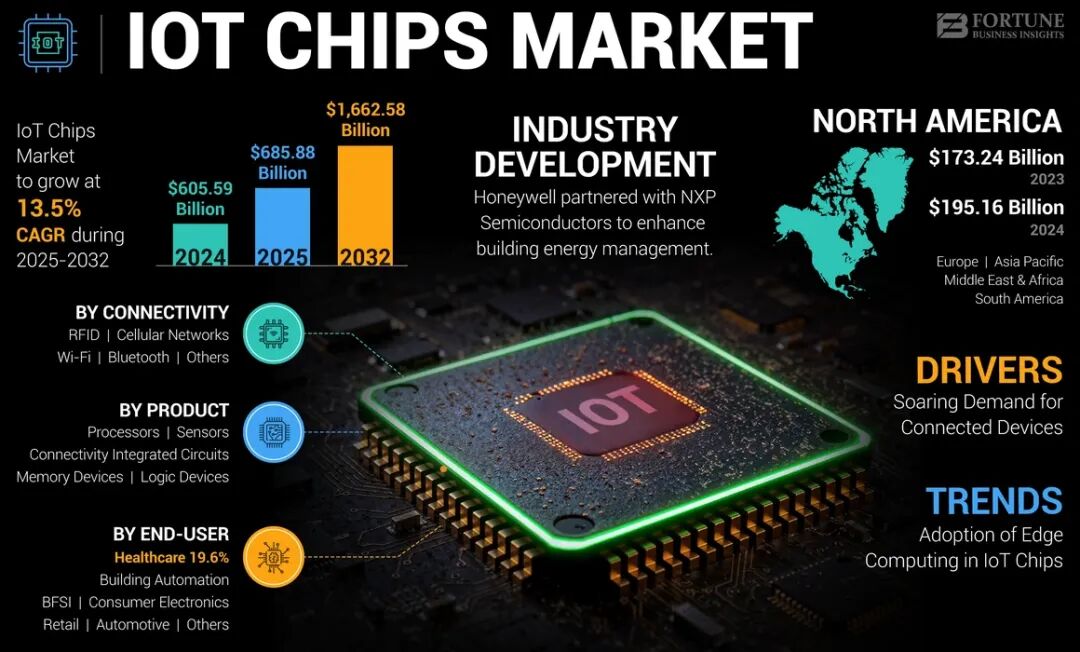

According to Fortune Business Insights, the global IoT chip market was valued at $605.59 billion in 2024 and is projected to grow from $685.88 billion in 2025 to $1,662.58 billion by 2032, reflecting a compound annual growth rate (CAGR) of 13.5%. In 2024, North America accounted for the largest share of the global IoT chip market at 32.23%.

Against the backdrop of this hundred-billion-dollar blue ocean IoT chip market, Silicon Labs’ current ambitions appear more like a starting point.

03

Concluding Remarks

Overall, the current round of shortages and price increases is not a widespread issue but is concentrated in niche applications such as drone electronic speed controller (ESC) MCUs.

It primarily reflects the combined effect of rapidly rising demand and tight spot supply channels. Although Silicon Labs remains a relatively niche brand, its deep expertise in IoT connectivity and MCUs gives its products a unique value in specific segments, making its market performance particularly noteworthy.