End Conclusion

In Huaqiangbei, some chip orders are starting to increase

01Have the orders increased? What is the current market situation?

Recently, many chip distributors have said that the number of orders has increased recently.

On social platforms and various group chats, we can see a lot of news that the business volume has doubled or even tripled. Looking at the circle of friends again, there seem to be more people posting orders than before, and some people even asked directly: "Has the chip market taken off recently?"

In addition, there have been more inquiries recently. Some distributors said that the demand for active parts has increased, and there are many inquiries of tens of K. More people are asking about automotive materials and conventional materials.

After asking several chip distributors, it can be found that after the New Year this year, the order volume of most distributors has indeed increased, but the growth rate varies. It is rare to double. Most people said that it is "slightly better than last year." In addition, some distributors said that there is no obvious change.

However, even if the order volume increases, most people are still not sure whether the chip market is really getting better, because the order price is too high, the profit is very low, and it is still in a state of grabbing orders at low prices.

Kevin, a chip distributor, said that the profit is particularly low now. Especially after the number of orders increases, everyone has the opportunity to roll up, and the profit is getting lower and lower. The current average profit margin is about the same as last year, which is still about 3%. However, because there are more orders, the overall profit is more than before.

Another chip distributor, Sandy, said that although he felt that his price was already very good, customers could always find a lower price, and there were still some companies in the market that were shipping at a loss.

In fact, if we look at it in the long run, there were already signs of growth in chip market orders last year.

In the first half of last year, an MLCC agent said that orders increased by 40% in the first half of the year. Some distributors also said that the business of domestic capacitors and resistors would be better than that of foreign brands, as long as the price was good, customers would not be too picky.

By the end of last year and before the Spring Festival, more people began to feel the growth in orders. Some were because customers routinely stocked up before the New Year, some were because customers received more orders and projects were mass-produced, and some were because the foundry business was getting better. In addition, there were also external factors such as year-end stocking and the US election, and some American products also had some demand.

After the Spring Festival, there would be some small peaks if the demand was not handled in time. Now, more than a month has passed, and the demand will be a little less than when the Spring Festival just ended, but overall it is still better than last year.

Looking back at the environmental changes in the entire chip market in recent years, the chip market has entered a long trough period since the second half of 2022. In 2023, chip distributors fell into a crazy internal roll, and price cuts and even loss-making shipments were common. Some general chips also continued to drop in price, first falling back to normal prices, and then falling into a market inversion.

After entering 2024, the market in the first half of the year seemed to be "stagnant water", and some people even bluntly said that it was as cold as the "Ice Age". Without orders, everyone can't roll up even if they want to, and many people simply "lie flat". However, many people have begun to try new ways out. Those who make European and American chips have begun to try to make domestic chips, distributors have begun to try new models of matching orders, and those who used to only do domestic trade have begun to try foreign trade.

In the second half of last year, the market began to see voices of price increases for some chips. For example, MPS, which had a small peak in demand in May, began to increase demand for automotive materials again in October and November, mainly for commonly used power management chips. For example, ADI, which has seen some improvement in demand since March, showed signs of some chips being "swiped" and inventory consumption in September. In the fourth quarter, some distributors said that ADI's inventory consumption has increased significantly. After the Chinese New Year, ADI's orders have increased, and the number of inverted chips has also decreased significantly.

In general, since the second half of last year, there have been some signs of a better market in the chip market from time to time, which has brought some confidence to everyone compared with the coldness in the first half of the year and before.

In addition, although it is not easy to make orders now and the prices are still very high, there has been good news about price increases in the market recently, such as ST's MCU and storage.

ST's MCU price reached a new low since 2023 around December last year, and then began to stop falling. As of March 2025, the price has rebounded; due to the suspension of production, Samsung's small-capacity eMMC storage has increased slightly since October last year, and the recent price increase has increased significantly.

Orders started to increase and some chips began to increase in price. The accumulation of good news has made the recent chip market a little turbulent.

02Is the market really getting better?

Although there is some good news in the overall market, everyone has different feelings when it comes to individuals.

Some distributors who mainly do trade said that the demand for consumer goods is a little more than before, and the level of industrial automobiles is still very competitive, but some people said that they did not feel a significant change.

Some agents said that the business after the New Year has been significantly better than the second half of last year, but some agents said that their order volume has decreased, but their profits have increased.

Sandy, who mainly does foreign trade, said that the current demand is still for drones, and there are also some industrial demands, but recently customers have begun to urge for goods. In the past, they did not urge for delivery a week late, but now they may be in a hurry to put on the production line.

Whether it is market or terminal, consumption or industry, automobile, domestic trade or foreign trade, it will affect the actual situation of distributors' business. Distributors who connect more with terminals said that customers have recently paid more attention to prices. In the past, they quoted the whole order, but now they require each material to have an advantage, and they will not let go of a few cents. Some even said that customers cut prices after the New Year. Those who connect more with trade have relatively less feeling of the recovery of demand.

In general, the order volume of most distributors has increased. The demand for consumer products seems to be better, while the demand for industry and automobiles is relatively weak. The report of Xinba Ge also shows that there have been seasonal fluctuations in consumer orders recently, orders from automobile and industrial manufacturers are sluggish, and orders from AI manufacturers have maintained strong growth.

However, the AI chip business does not seem to be optimistic.

According to Quiksol, Broadcom's AI chips are still the "clear stream" in the market and maintain high prices. Although Broadcom AI was popular in January, there were more inquiries and fewer transactions for related chips, and the market price remained high and fluctuated greatly, mainly depending on the return of goods in that month. In March, affected by Deepseek, the surge in AI demand drove the demand for PCI-E Switch, and the market response continued to be hot, and the price remained high.

However, there are also distributors of HBM storage chips related to AI servers, saying that the business is not very stable. When there is no stock in the market, customers will go to the market to find goods. Therefore, HBM has arrived in large areas in the market recently, and the upstream transactions seem to be good, and the spot market is relatively cold.

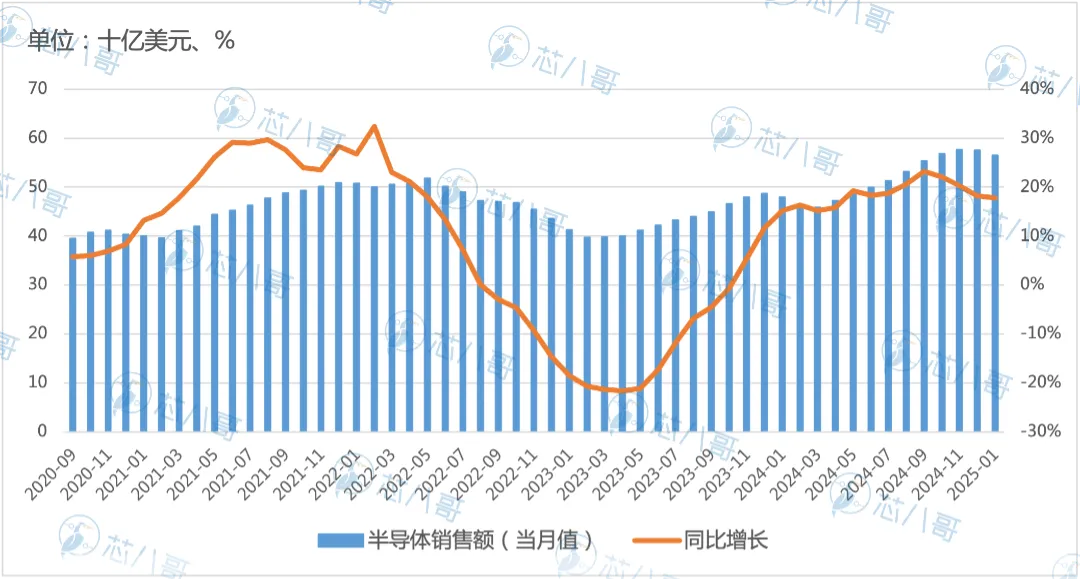

In addition, according to the monthly global chip sales data from SIA, the global semiconductor market sales in January 2025 were US$56.52 billion, a year-on-year increase of 17.9%, and the year-on-year growth rate exceeded 17% for 9 consecutive months.

The peak of the previous wave was in the middle of 2022, which was the highest point in the figure below. After that, it fell all the way to the bottom and then slowly rose again. The market began to have good news around the fourth quarter of last year, and the data in the figure also showed the same phenomenon. It started to rise around the fourth quarter of last year and exceeded the high point in 2022. Therefore, the data can still reflect some market conditions, and the current growth trend can also bring some confidence to the

market.

However, this does not mean that the market will improve across the board. Because from the performance of the original factory, the revenue of AI-related manufacturers will increase significantly in 2024. Although storage began to weaken in the second half of the year, many related manufacturers also set new highs in annual revenue. However, chip manufacturers that focus on the industrial, consumer, and automotive markets are not so good. Last year, the revenue of major manufacturers such as TI, ST, NXP, and Renesas fell year-on-year.

At the same time, major manufacturers have also taken intensive cost-cutting measures since last year. Microchip began to close factories and lay off 2,000 employees at the end of last year, NXP laid off 1,800 employees worldwide, and TI recently announced that it will lay off employees.

However, everyone has also felt some good news in different aspects. For example, some said that they are now asking customers to prepare some goods, and customers have also prepared some. Some said that the bosses who had "lying flat" before are now starting to collect inventory again, and the demand for obsolete materials has begun to increase.

Kevin said that the delivery time of some original factories has been extended recently, and those who place orders now will not be shipped until several months later. At the same time, some distributors also stated on social platforms that the current packaging factory production capacity is insufficient, and the delivery time of some chips will gradually increase.

03

At present, not everyone feels that orders have increased, and the financial reports of major manufacturers continue to be "sluggish", but the market has indeed shown signs of improvement. However, we cannot be blindly optimistic. The overall situation this year will probably be better than last year, but this "good" is mostly structural. We still have to wait and see when the market will fully recover.