This major analog chip manufacturer is still seeing crazy growth in its performance!

01

MPS chip spot market Continued fluctuations

Over the past two years, the analog chip market has been generally sluggish, yet MPS (Monolithic Power Systems) has still experienced periodic surges in the spot market, becoming one of the focal points in the distribution sector.

The initial uptick began in October 2023, with demand gradually increasing by April 2024, primarily driven by consumer and industrial applications. By May 2024, demand sharply spiked, including AI power-related chips and some automotive chip demands. Strict control from the original manufacturer, prolonged lead times for transfers, capacity allocation issues, and rumors of order suspensions pushed MPS's market performance to a peak.

After reaching its zenith in July 2024, MPS's demand gradually cooled in the second half of the year. However, by the end of 2024, another wave emerged, with noticeable growth in automotive chip demand.

Moving into early 2025, several distributors working with MPS observed a surge in demand centered on drone applications.

Manager Zhao (pseudonym) noted that MPS demand had clearly risen. In March and April, several regularly scheduled orders failed to arrive, likely due to prioritization for major clients, with deliveries postponed until Q3. He recalled that as early as late 2024, some had mentioned increasing demand, but it wasn’t taken seriously at the time.

Alex (pseudonym) mentioned that there was indeed a wave of demand at the beginning of the year. Their drone customers were all overseas, and they didn’t engage with a certain leading client due to unfavorable payment terms for spot traders. Comparatively, he observed more demand for ADI in the drone sector, noting that while MPS performs well, the main control chips still heavily rely on ADI.

However, several sales contacts observed that starting late May, MPS's market demand began to decline, with conditions leveling off:

"Demand was decent at the beginning of the year, but there’s been a downward trend since late May."

"We’re barely working with this brand now—demand is mediocre, and business is tough."

"We only started handling MPS this year. There’s been a lot of inquiries, but actual transactions are few, and MPS is hard to source."

Alex, whose clients span BMS (battery management systems), automotive electronics, medical, and other sectors, believes that MPS's hottest products remain AI power chips. However, the market generally exhibits a pattern of "high inquiry volume but low order conversion."

He pointed out that, at similar costs, MPS is harder to sell than TI. Yet, in high-end markets like medical and industrial applications, MPS's stability and performance remain competitive, making it suitable for clients prioritizing reliability—especially in medical applications, where MPS solutions are frequently adopted. However, due to its limited overall market share, distributors typically don’t stock large quantities, instead making advance arrangements based on specific client needs. This often leads to shortages when urgent demands arise.

A contact primarily responsible for order scheduling also noted a contradiction in MPS's current situation: "Clients who can schedule orders can’t wait for the lead time, while those who can wait often can’t agree on pricing." Additionally, there remains a significant amount of high-priced inventory procured in 2022, coupled with highly transparent market information, making transactions challenging overall.

Alex added that while MPS's general-purpose components were still in demand last year, inquiries have dwindled by May this year, and even when inquiries occur, few result in orders.

However, in contrast to the above observations of weakening demand, some distributors working with MPS report that demand remains robust: "Our orders are backlogged for months, with no stock to fulfill them, and we’re still receiving a flood of inquiries."

From MPS's Q1 2025 financial report, both accounts receivable and inventory levels have risen, with the sales collection cycle extending by six days and inventory turnover time increasing by eight days to 146 days. The company is preparing for anticipated order growth, though the original manufacturer has cautioned that short-term operational adjustments may be needed to avoid declining capital efficiency.

02

Record-breaking growth for 13 consecutive years

Why does MPS rely on this?

Regardless of fluctuations in the spot market, MPS (Monolithic Power Systems) has stood out in recent years with consistently strong performance, even as the global analog chip industry experienced slowing growth and weaker results among major players.

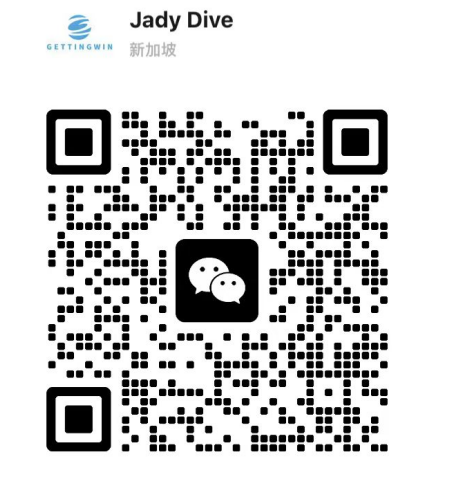

In 2024, MPS achieved its 13th consecutive year of record revenue, reaching $2.2 billion, a 21.2% year-over-year increase. The growth was primarily driven by an optimized product portfolio, which boosted both shipment volumes and ASP (average selling price). Although gross margins declined from 58.4% in 2022 to 55.3%, they remained at a high level. In Q1 2025, MPS revenue surged to $640 million, up 39.2% year-over-year, setting yet another historical high. The company attributed this performance to the sustained advantages of its diversified market strategy and the continuation of order trends from late 2024.

While MPS’s revenue scale still lags behind traditional analog chip giants, its growth momentum has been stronger. TI reported $4.07 billion in revenue for the same quarter, up 11% year-over-year. ADI’s Q1 FY2025 (ending February 1, 2025) revenue was $2.42 billion, down 3.58% year-over-year, marking its seventh consecutive quarterly decline. However, by Q2 (ending May 3, 2025), ADI’s revenue rebounded with 22% growth. Meanwhile, Infineon posted €3.591 billion in revenue, a slight 1% decline.

MPS has demonstrated remarkable resilience and market penetration, steadily carving out a high-growth trajectory against the broader industry trend.

In 2024, MPS maintained a high operating margin of 24.4%, reflecting strong returns on its investments in product development and market expansion. Net profit soared to $1.787 billion, up 318.1% year-over-year, driven by significant progress in high-power clean energy applications, automotive audio, and enterprise notebook solutions.

MPS continues to ramp up R&D investments, with Q1 2025 R&D spending rising steadily to $133.5 million, contributing to a 5.9% year-over-year increase in non-GAAP operating expenses. These expenditures are being channeled into expanding the product portfolio and supporting growth in the coming quarters. Operating cash flow for the quarter reached $256.4 million, with over $1 billion in cash reserves, providing a solid foundation for future R&D, acquisitions, and production expansion.

Although it is difficult to find MPS in the list of top manufacturers in terms of global analog chip market share, it has become a "small but sophisticated" emerging force in the global analog chip field.

MPS Development History

1997: The company was established and developed the first chip.

1998: Launched a single-chip solution for powering CCFL backlights in PCs.

2002: CCFL backlight inverter chips accounted for 80% of revenue.

2004: Successfully went public; Chengdu company was established.

2005: DCDC products became the largest source of revenue.

2008: Increased investment in Chengdu and established Phase II.

2010: Entered the automotive electronics field and developed Intelli-phase technology.

2012: Invented QSMOD.

2014: Provided core power solutions for Intel Grantley server platforms for the first time; Acquired Swiss company Sensima.

2019: Established Phase III in Chengdu to build China's largest analog chip R & D center.

2021: Acquired LogiSiC, a seed-round startup designing radiation-tolerant silicon carbide devices.

2024: Acquired DSP company Axign B.V.

MPS was founded by Chinese American Michael Hsing and others in 1999, with the vision of "building the entire power system into a single chip". The company emphasizes integrating more circuit functions into a single chip to improve efficiency, save space and reduce BOM costs with high integration. For example, when it first entered the notebook backlight market, MPS compressed the modules that originally required more than 70 discrete devices to more than 20.

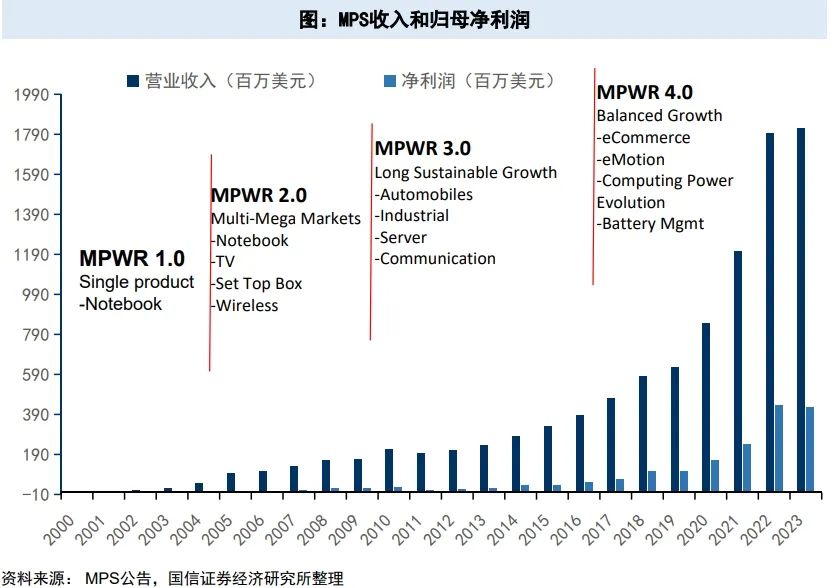

In 2004, MPS was listed on NASDAQ and established the world's first wholly-owned subsidiary in Chengdu to lay out a global R&D and delivery system. Subsequently, the market value continued to rise, and in 2024 it once exceeded US$40 billion.

From 2018 to 2024, MPS's revenue jumped from $600 million to $2.2 billion, and its profit surged from $100 million to $1.8 billion. In 2021, it became the only emerging analog chip company with revenue exceeding $1 billion in the past 30 years, and in 2023 it ranked among the top ten IC design companies in the world. At present, the company has launched more than 4,000 products, serving more than 30,000 customers worldwide, covering multiple growth markets such as industrial control, electric vehicles, and AI servers.

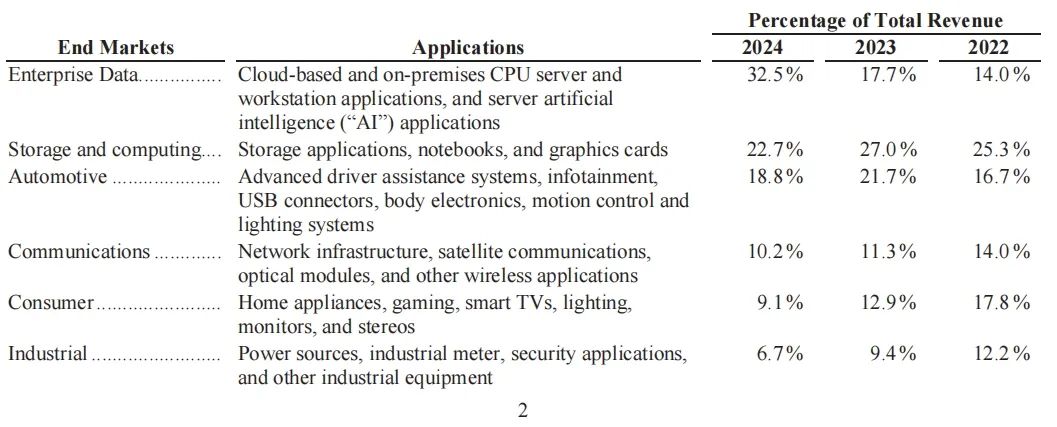

In terms of products, MPS's revenue is highly concentrated in the DC/DC product series, accounting for as much as 94% in 2023, and the rest is lighting control products. From the perspective of the terminal market, MPS is divided into six major areas: enterprise data, storage and computing, automobiles, communications, consumer electronics, and industry.

Unlike large companies, how did MPS achieve sustained growth without aggressive acquisitions of "buy, buy, buy"?

MPS has taken "small and fine" to the extreme.

First of all, not building its own wafer fab allows MPS to go into battle lightly. As a Fabless company, MPS emphasized in its financial report that the Fabless model enables MPS to focus on its core strengths while reducing fixed costs and capital expenditures.

In fact, MPS has a typical "engineer culture" - it does not burn money or expand aggressively, but relies on the growth path that is polished bit by bit by the technology itself, and has established a solid technical and commercial moat around various "pragmatisms".

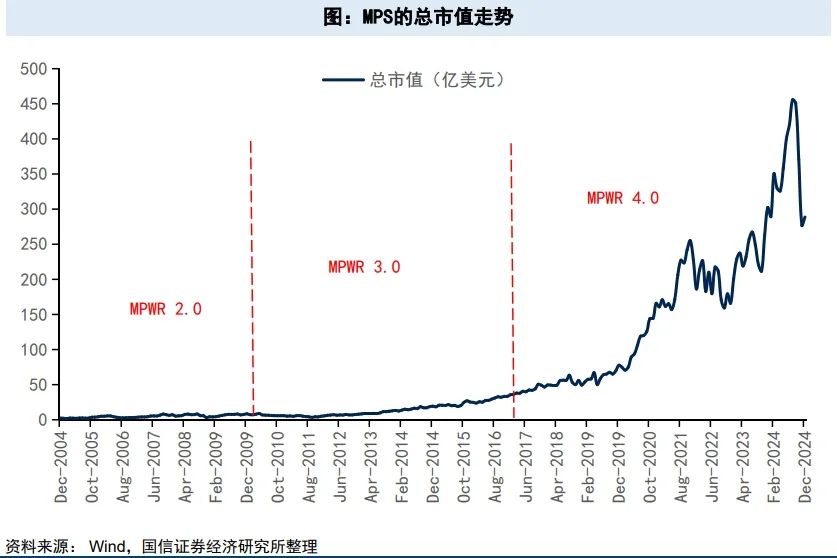

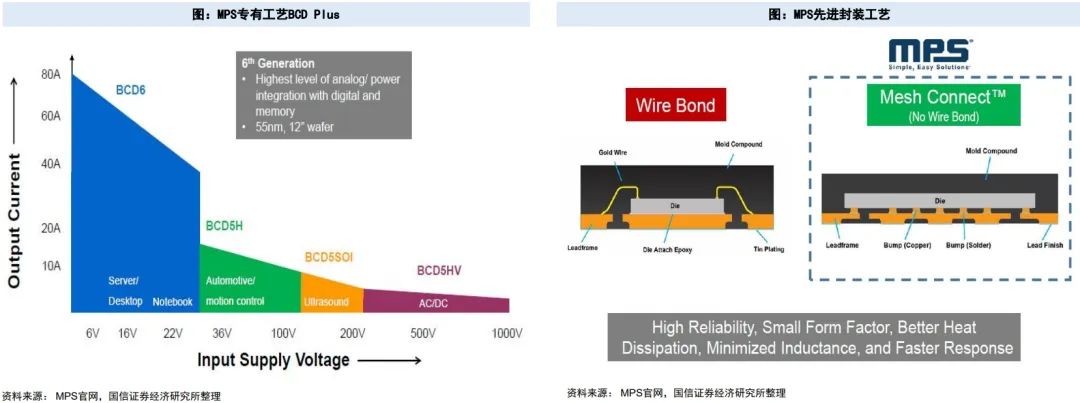

Unlike general Fabless companies, MPS develops its own proprietary processes and packaging technologies, such as BCD Plus and Mesh Connect™, and cooperates deeply with TSMC to deploy its own processes on production lines to improve performance and yield.

MPS does not pursue horizontal "casting a net" scale expansion, but expands to the field of precision analog with DC/DC as the core, expanding from single IC to subsystem, which is MPS's killer. It focuses on establishing a leading position in key high-value fields, such as DC/DC converters, highly integrated power modules (Power Module), server power supplies, automotive motor drives (BLDC), etc., and achieves long-term compound growth in a small but refined way.

It is also very restrained in mergers and acquisitions, only selecting small technical projects that can strengthen its own platform, such as the acquisition of Swiss Sensima (magnetic encoder technology) in 2014 and the acquisition of Axign (Class-D DSP audio technology) in 2024, and quickly integrating them into its platform products to enhance the overall solution value.

It is also very particular about market strategy, expanding the terminal market in stages and rhythmically, and the company's revenue and profit scale continues to set new highs. MPS, which started in consumer electronics applications such as laptops, has now found a breakthrough in the AI vent and has become a leading company in the global multi-phase power supply field, providing key power management chips for AI server-related customers such as NVIDIA and AMD.

With the rapid growth of data center demand and the increasing power consumption of servers, multi-phase power solutions (multi-phase controller + DrMOS) are currently recognized as the best solution for CPU/GPU power supply. MPS has already laid out its layout as early as 2010. Today, its multi-phase power supply solutions are widely used by mainstream server customers.

The enterprise data market has become MPS's largest terminal market, with revenue share doubling from 14% two years ago to 32.5% in 2024, with an annual growth rate of 121.8%, thanks to the increase in sales of power management solutions for AI applications.

MPS stated in its 2024 financial report that despite facing cyclical industry downturns, the company has selected specific products and market areas that enable MPS to maintain above-industry average performance over the long term.

03

End Conclusion

Looking ahead to 2025-2027, MPS has set clear and challenging financial goals in its recent performance statement. On the revenue side, the company plans to continue to grow at a rate that exceeds the overall market growth rate by 10%-15%; on the profit side, it is committed to stabilizing the gross profit margin at 55%-60%, aiming to ensure a balance

between product profitability and cost control. MPS's growth rhythm can be described as "running fast in small steps, step by step", deepening the market bit by bit. Once this type of technology-oriented growth chip company gets going, it may be able to go a long way.