This Shenzhen MCU company was listed on the Hong Kong stock market and its chips became popular

01

Chip stocks boom after HK listing

Fengqi's Hong Kong IPO has become the "first stock of motor drive control chips" in the semiconductor industry in the Hong Kong market, and it is also the largest semiconductor enterprise IPO project

issued in Hong Kong stocks since 2015, with a total fundraising of HK$2.259 billion.

Behind this is the strong performance in recent years. In 2024, Fengqi's revenue reached 600 million yuan, a year-on-year increase of 45.9%, and a net profit of 222 million yuan. Except for a slight decline in 2022, the remaining years have been growing at a high speed, and the revenue has doubled several times in a few years.

Not only is the business fierce, but the hands are also getting more and more wealthy. For example, last year, Fengqi bought a building-its wholly-owned subsidiary "Fengqi Semiconductor" plans to

purchase Building 5 of "Shanghai Langshi Green Center" in Shanghai, with a construction area of about 5,724 square meters and a transaction price of 130 million yuan. At present, Fengqi is

headquartered in Shenzhen, and has subsidiaries and service centers in Shanghai, Qingdao, Shunde, Singapore and other places.

Fengqi has already landed on the Science and Technology Innovation Board as early as 2022. The purpose of choosing to go public in Hong Kong this time is also very clear. The second listing in Hong

Kong can further open up overseas markets. The goal is to increase the proportion of overseas revenue to 20% in 2028. Although its overseas revenue accounted for only 6.2% in 2024, the growth rate

was significantly higher than domestic revenue. Going overseas may be a feasible way. According to the prospectus, about 16% of the net proceeds from this time are expected to be used to expand

overseas sales networks and overseas market promotion. This is also highly consistent with its actions in recent years-in December 2022, Fengqi registered and established an indirect wholly-owned

subsidiary "Fengqi International" in Singapore; in November 2024, it established "Fengqi Japan" in Japan to gradually lay the foundation for overseas business.

In addition to the capital market, Fengqi is also a brand that is constantly talked about in the chip spot market. Fengqi is a rare domestic hot chip. Last year, the demand for related models increased

significantly, and there were also reports of shortages. Among them, the representative model FD6288Q is an electric adjustment chip, which is widely used in three-phase brushless DC motor drives

for model aircraft and drones. Last year, it was reported that the production capacity of this chip was tight, and it is said that it is still in short supply in the first half of this year.

It is worth noting that Fengqi mainly adopts the payment to delivery model. In 2024, the accounts receivable were only 5.64 million yuan, accounting for 1% of the annual revenue. This means that the

original factory may have more supply itself, and can maintain a certain pricing and delivery capacity when the market is out of stock.

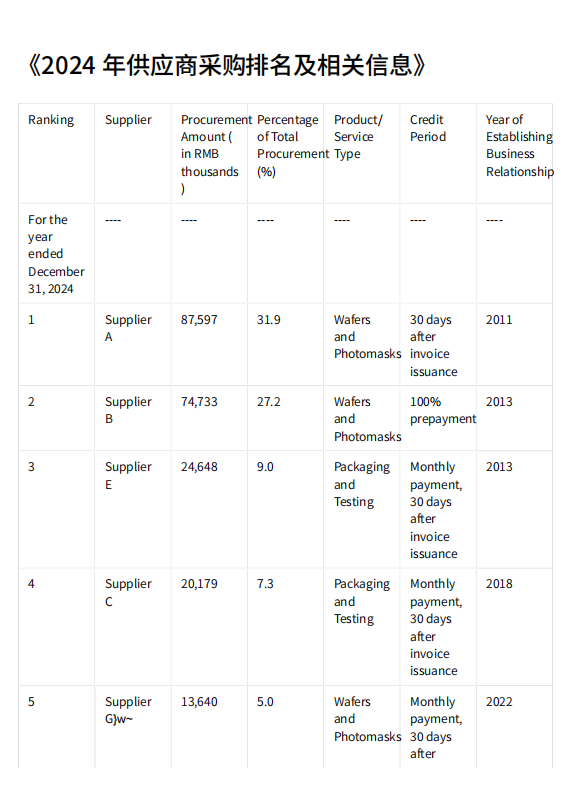

From the perspective of production capacity structure, according to the prospectus, Fengqi's current wafer production capacity mainly relies on GlobalFoundries and TSMC. Although a local

semiconductor manufacturing listed company in Anhui was added in 2022, the proportion is still only in the single digit. Although there is no long-term agreement with major

suppliers, Fengqi said that in view of the long-term cooperative relationship in the past, it believes that the supply relationship will remain stable.

From the perspective of the sales system, Fengqi is still mainly based on distribution (accounting for 95.7%). In 2024, the revenue from the top five customers (all dealers) accounted

for 46.8% of the total revenue, and the revenue from the largest customer accounted for 15.0% of the total revenue.

However, after Fengqi became popular and went viral, there were more negative voices in the discussion about it. Some dealer friends said that the attitude of the original

manufacturer now seems to be less friendly than before. Some market insiders commented under the relevant topic: "Its solutions basically rely on the support of the original

manufacturer's technical team to run, but now it is a bit "cold", not paying much attention to small customers, and there is a feeling of "use it if you like it or not".

02

How High-Profit, High-Barrier Strategies Win in BLDC Chip Sector

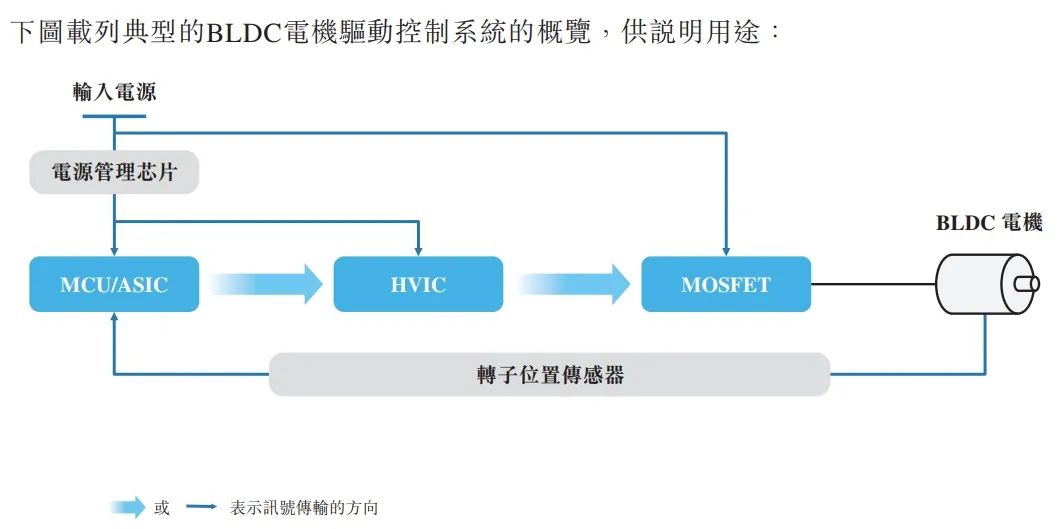

At a time when domestic chips are constantly breaking through, Fengqi has grown into a leading company in the field of domestic BLDC motor drive control chips. The company

focuses on BLDC motor drive control chips, and its product line covers MCU/ASIC, motor drive dedicated high-voltage chips (HVIC), power MOSFET and IPM, which almost constitute

a complete BLDC motor control system. Its core product, the motor main control chip MCU, accounts for as much as 64.06% of the company's revenue in 2024.

According to Frost & Sullivan, Fengchi is the only company in many segments, including smart small appliances and power tools. In 2023, its Chinese market share of BLDC motor

master control and driver chips used in vacuum cleaners and electric fans will reach 80.7% and 83.6%, respectively. The revenue of Fengchi's top five customers accounts for more

than 55%, including leading companies such as Midea, Haier, and Ecovacs.

Compared with traditional brushed DC motors, BLDC motors (brushless DC motors) eliminate mechanical commutators and have simpler structures. They have the advantages of

small size, light weight, high efficiency, excellent torque characteristics, stepless speed regulation, and strong overload capacity. Downstream applications mainly include home

appliances, civil drones, smart robots, electric vehicles, power tools, and servo systems. These downstream markets continue to grow and have become Fengchi's main battlefield.

In recent years, my country's BLDC motor drive control product market has grown rapidly:

● From RMB 8.6 billion in 2019 to RMB 25.3 billion in 2023, with a compound annual growth rate of 30.8%;

● It is expected to further increase from RMB 33.1 billion in 2024 to RMB 80.8 billion in 2028, with a compound annual growth rate of 25.0%.

Among them, power devices and main control and driver chips are the two most core products, accounting for more than 80% of the market share, while main control and driver

chips account for 30.6%.

In the field of main control and driver chips, TI, ST, Infineon, Cypress and other international manufacturers have long dominated the market. The top five manufacturers in 2023

accounted for a total of 55.1% of the market share, and domestic manufacturers include Fengqi, Zhongying Electronics, Silan Microelectronics, etc. Among them, Fengqi ranked

sixth in the Chinese market (including local and overseas manufacturers) with a market share of 4.8% in 2023, and it is also the only Chinese company among the top ten

manufacturers. In its 2024 annual report, it stated that the company's motor drive control chips have obvious differentiated competitive advantages such as excellent performance,

reliable quality, and high cost performance, and gradually achieved import substitution. The reason why Fengqi has become the leading player in domestic BLDC motor chips is

mainly due to more than ten years of research and development. The company has created an ME core with independent intellectual property rights, and has also made it a "dual-

core" with stronger computing power. It can cope with various complex motor control scenarios and integrate chips, algorithms and motor technologies into a set of solutions. The

prospectus also mentioned that its products can effectively help end customers solve industry pain points such as non-sensing high-torque starting, silent operation and ultra-high-speed rotation.

Fengqi's development path can be traced back to 2010, when Fengqi released the first three-phase non-sensing BLDC chip, breaking the foreign technology monopoly. From 2013 to

2018, domestic substitution accelerated, algorithm hardware was realized, products entered the field of smart home appliances, and the cumulative shipments of chips exceeded

100 million. Since then, benefiting from the increased penetration rate of BLDC motors in various terminal fields, the business scale has developed rapidly, and the cumulative sales

of products in 2024 will exceed 390 million.

At present, Fengqi's main revenue comes from smart small appliances (accounting for about 50%), followed by white appliances (accounting for 19.6%).

In terms of performance, from 2022 to 2024, Fengqi's revenue will be approximately RMB 323 million, RMB 411 million, and RMB 600 million, respectively, with year-on-year growth of 27.4% and 45.9% in 2023 and 2024, respectively. The rapid growth in 2024 is mainly due to the enhanced product advantages and the rapid growth of sales revenue in white appliances, industry and automobiles.

Net profit increased from RMB 142 million to RMB 222 million during the same period, and the net profit margin remained high, at approximately 43.97%, 42.50%, and 37.04%,

respectively. The gross profit margins are approximately 57.34%, 53.16%, and 52.64%, respectively. According to Frost & Sullivan's data, its gross profit in 2024 is 52.6%, which is

higher than the average gross profit margin of its peers in the Chinese market. The company's independently developed "8051+ME" dual-core architecture effectively avoids ARM

licensing fees, making its gross profit margin higher than that of its competitors.

At present, Fengqi's main revenue comes from smart small appliances (accounting for about 50%), followed by white appliances (accounting for 19.6%).

In terms of performance, from 2022 to 2024, Fengqi's revenue will be approximately RMB 323 million, RMB 411 million, and RMB 600 million, respectively, with year-on-year growth of 27.4% and 45.9% in 2023 and 2024, respectively. The rapid growth in 2024 is mainly due to the enhanced product advantages and the rapid growth of sales revenue in white appliances, industry and automobiles.

Net profit increased from RMB 142 million to RMB 222 million during the same period, and the net profit margin remained high, at approximately 43.97%, 42.50%, and 37.04%,

respectively. The gross profit margins are approximately 57.34%, 53.16%, and 52.64%, respectively. According to Frost & Sullivan's data, its gross profit in 2024 is 52.6%, which is

higher than the average gross profit margin of its peers in the Chinese market. The company's independently developed "8051+ME" dual-core architecture effectively avoids ARM

licensing fees, making its gross profit margin higher than that of its competitors.

03 Summarize

With its accumulated technology and product scale, Fengqi has carved out a niche in the tide of domestic substitution. Although its scale is small, its foundation is solid and its overseas layout is also continuously advancing. Whether it can reach new heights in the next stage depends on its next strategy.