Power Bank Market worth 100 Billion Yuan,Which chip companies are full?

01

The chip industry chain behind the 100 billion market

The functions of power banks (mobile power sources) have become more and more popular in recent years. They not only need to have large capacity and support fast charging, but also be compatible

with multiple devices and protocols, and even have wireless charging. It is best to be thin and light, so that you don’t feel tired when carrying it with you. In mobile scenarios such as going out and

traveling, power banks have long become a rigid demand. Not only is the demand very stable, but they are basically replaced every two or three years.

According to the different battery types, capacity sizes, number of interfaces and charging technologies, power banks present a variety of product forms, meeting a variety of usage needs from basic

charging to multi-device fast charging and wireless charging.

According to the data from Big Data Cross-border, the global mobile power market size has reached US$16.3 billion in 2024 (+8.7% year-on-year); it is expected to further expand to US$32.9 billion

(about RMB 236.1 billion) by 2033, with a compound annual growth rate (CAGR) of 8.2% from 2023 to 2033, and there is considerable room for development.

Data shows that in 2022, the first-tier manufacturers of mobile power in the world are mainly Anker and Xiaomi, with a total market share of 19.93%. ROMOSS ranks in the second tier, with Samsung,

ZAGG and others accounting for 12.48% of the market share. China is the main center of mobile power manufacturing and innovation, and is also a major player in the global market.

Take ROMOSS, the recent focus of public opinion, as an example. In 2011, the non-removable battery design of smartphones gradually became mainstream, giving birth to the mobile power market,

and ROMOSS became one of the earliest pioneers. Public information shows that in 2012, the founder gave up the laptop battery OEM business and founded the ROMOSS brand. In the same year, it

launched the first 10,000 mAh large-capacity mobile power bank, which quickly won the market with its minimalist design and ultra-high cost performance. As early as 2015, ROMOSS entered the

overseas market, and its overseas revenue accounted for 40% in 2022. ROMOSS has been the top seller in the mobile power bank category on Tmall's "Double 11" for 11 consecutive years, claiming to

be sold in more than 80 countries and markets, with annual shipments of more than 50 million units.

From the upstream of the industry chain, power banks mainly include three parts: the battery cell part (determines the power and safety), the circuit board part (boost system and

charging management system), and the shell structure (affects the feel, appearance and heat dissipation).

Among them, an excellent circuit board can make the mobile power bank play its maximum performance, protect the battery cell, reduce loss and heat, and maximize the

conversion of battery cell energy into output energy. At the same time, it also has the function of stabilizing voltage and current, and ultimately protects the charging safety of

digital devices such as mobile phones.

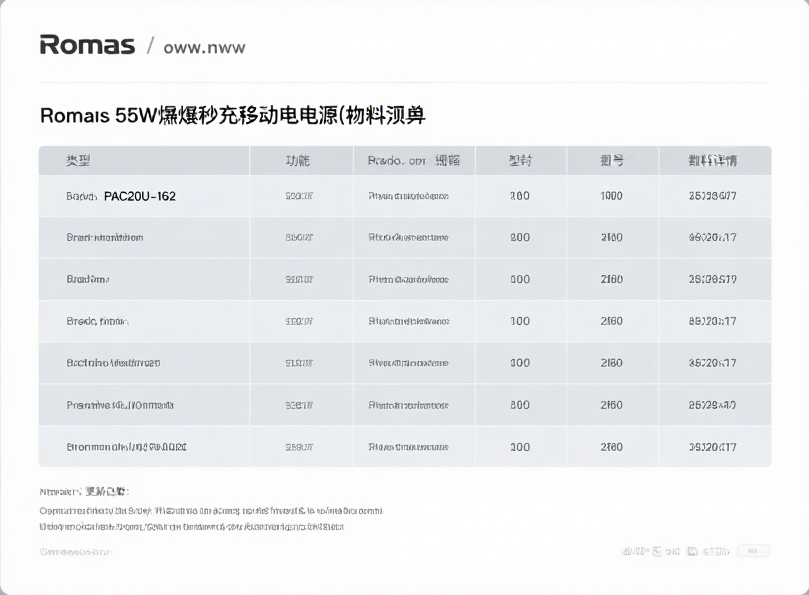

The circuit boards of mobile power banks are similar, including IC chips, power devices, and capacitors. According to Dingjiao One, the cost of a high-quality battery cell with high

safety performance is about 40-50 yuan, plus the shell, circuit board and other components, at least about 10-20 yuan, and the cost alone may be fifty or sixty yuan. In general, the

cost of the chip is not high. The cost of the main control + protocol chip in the mid-to-high-end power bank is generally about 10% of the whole machine.

Through the disassembly of many power bank products on the market, it is learned that the standard configuration of the IC chip of a power bank includes mobile power SoC,

battery/lithium battery protection chip, MCU and other chips (battery balancing chip, power meter chip, etc.).

Let’s first look at the core chip, which is also the mobile power SoC with a relatively high cost share. It is a highly integrated “power master” that integrates battery charge and

discharge management, power conversion (boost/step-down), fast charging protocol recognition, MOS drive, power detection, safety protection and other functions. It is

equivalent to the “brain” of the entire power bank.

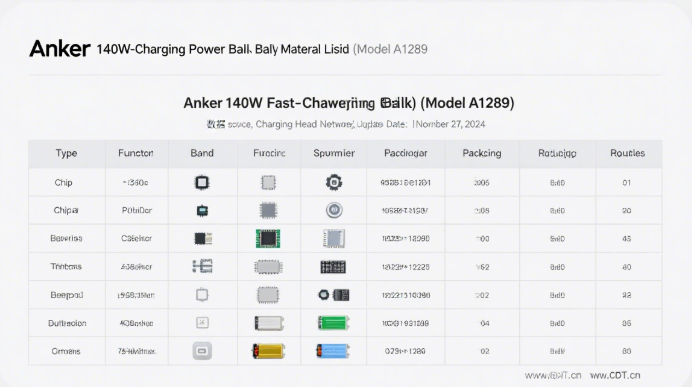

Not all power banks use the SoC solution. Some products use a discrete solution - a combination of independent protocol chips (to identify and negotiate fast charging protocols),

boost chips and buck chips, such as the Anker A1289 fast-charging mobile power bank material list shown in the figure below.

With the development of the industry, mobile power solutions have gone through three stages from separation to integration, and then to fast charging SoC, with higher and higher

integration. In this process, domestic chips have been deeply cultivated for many years, with significant cost-effectiveness advantages. While being self-sufficient, they are also sold

all over the world. Data shows that more than 90% of the global power bank power control chip market is currently occupied by domestic companies.

Next is the indispensable battery/lithium battery protection chip in the power bank, which acts as a safety gatekeeper and is mainly responsible for the protection of abnormal

conditions such as overvoltage, overcurrent, and short circuit to ensure safety during use.

The battery protection chip emphasizes serving the entire mobile power system. In mid-to-high-end products, more complex battery protection + management chips will be used.

The lithium battery protection chip emphasizes protecting the battery itself, and is often used in low-end solutions, or the mobile power SoC is equipped with a simple lithium

battery protection chip.

In addition to the core main control and protection chips, there are some chips in the power bank that are installed on demand, depending on the product positioning and

functional complexity.

For example, battery balancing chips are often found in high-end or large-capacity (such as 30W or more, multiple cells in series) products; fuel gauge chips are mainly used in mid-

to-high-end or products with digital display of power; battery meter chips have a high degree of overlap with fuel gauge functions and are mostly used in multi-cell battery

solutions. If the main control chip has built-in battery sampling and power estimation, it can be omitted; voltage regulator chips are used for low-voltage power supply (such as

driving small screens or LED displays), and can be omitted if the main control chip is built-in.

Of course, the power bank will also be equipped with an MCU (microcontroller) to undertake auxiliary control tasks, responsible for handling interface, interaction and information

management functions, and does not participate in power conversion. Some support fast charging protocol control and act as protocol chips.

These chips together constitute the complete control system behind the power bank, and the specific matching scheme also reflects the product's trade-offs in function, positioning

and cost control.

02

Power bank chips, which manufacturers are making a profit?

Combining the disassembly cases of power banks on the market and the public information of enterprises, we have sorted out a group of domestic chip manufacturers with high

relevance and representativeness in the field of mobile power (power bank) (ranking in no particular order). These companies mainly focus on power management, fast charging

protocol, battery protection and other links.

Yingjixin, one of the first domestic chip manufacturers to open up the power bank market, was established in 2014 and is one of the important chip suppliers in the application

fields of domestic mobile power, fast charging power adapters, etc. Its mobile power SoC is widely used in the industry, and it also provides fast charging protocol chip solutions.

According to the official WeChat account of Ingenic, its IP5306 mobile power fully integrated chip launched in 2016 once occupied about 20% of the global mobile power chip market. One out of every five power banks in the world is equipped with IP5306. Since 2015, the company has launched a new generation of mobile power chips every year. With

digital-analog hybrid technology as the core, the company integrates various rich functions in a single chip to provide highly integrated, cost-effective and flexibly configurable

power management SoC chips.

The 2024 annual report shows that the company achieved revenue of 1.431 billion yuan, a year-on-year increase of 17.66%; net profit of 124 million yuan, a year-on-year increase of 323.01%. Business growth is due to the increased demand for efficient power management and fast charging functions of smart devices. Among them, power management chip

revenue accounts for about 74%, and fast charging protocol chips account for about 24%. Products cover energy storage chips, car charging chips, wireless charging chips, TWS

headset charging warehouse chips, fast charging protocol chips, etc. Customers include Xiaomi, OPPO, vivo, Samsung, Honor, etc.

In recent years, the revenue of Ingenic has continued to rise, with a surge of 100.56% in 2021, which is related to the high market growth, accelerated domestic chip substitution,

and a substantial increase in the number of fast charging protocol chips purchased by Xiaomi and OPPO. The company's prospectus shows that from 2018 to the first half of 2021,

power management chips for mobile power supplies have always been its main source of revenue.

Zhirong Technology, from the disassembly of many products, it can also be seen that many power banks use its power SoC solution. It once rushed to the Science and Technology

Innovation Board IPO in 2022 but was withdrawn. During this period, it was sued by Ingenic for product patent infringement.

Zhirong Technology was established in 2014 and has been deeply engaged in digital-analog hybrid chips for many years. It is widely used in mobile power supplies, car chargers,

gallium nitride chargers, outdoor energy storage power supplies and smart sockets. Its wired/wireless fast charging, low-power and high-efficiency power management ICs, etc.

rank among the top in the consumer electronics and 3C accessories market, and its customers include Huawei, OPPO, Lenovo, Bull, ANKER, ASUS, etc.

According to the prospectus, from 2019 to 2021, Zhirong Technology's revenue compound growth rate reached 111.71%, and mobile power revenue accounted for about

60%-70%, which is one of its core businesses. Its lithium battery fast charge and discharge management chips are widely used in mainstream brands such as ROMOSS, BASEUS,

PISEN, UGREEN, and Anker, and are also extended to scenarios such as smart homes and power tools.

Saiwei Microelectronics, founded in 2009, takes battery management chips as its core and extends to more types of power management chips. Its products are used in laptops

and tablets, smart wearable devices (TWS headphones, etc.), power tools, charging products (mobile power supplies, etc.), light electric vehicles, cordless home appliances

(vacuum cleaners, etc.), smart phones, drones, AR/VR devices and PD mobile power supplies, etc. Its battery metering chip has the characteristics of "high precision, low power

consumption, and simple application solutions", filling the gap in the field of battery metering chips in China. It has strong competitiveness and is used in terminal products such

as Samsung, Honor, Xiaomi, and PXB Global. In terms of other chips such as charging management, it focuses on some high value-added fields and has entered the notebook

computer giant. It is also used in the products of well-known customers such as Anker Innovations, Rode, Zimi, and IKEA.

In 2024, Saiwei Microelectronics achieved revenue of 393 million yuan, a significant year-on-year increase of 57.64%. The company's main products are battery safety chips and battery metering chips, of which battery safety chips accounted for 46.6% and battery metering chips accounted for 37.79%. From 2020 to 2021, Saiwei Microelectronics' revenue increased by 102.98% and 88.31% year-on-year.

Xinhai Technology is one of the common brands of protocol chips (MCU control + fast charging protocol identification in one) and buck-boost chips in mobile power supplies. It is an integrated circuit design company that has both analog signal chain and MCU dual-platform drivers. The prospectus shows that the company launched the first domestic mobile power dedicated MCU chip in 2014, and launched the first domestic 32-bit MCU chip with built-in USB3.0 PD fast charging protocol in 2018.

The 2024 annual report shows that the company's general-purpose MCU has rapidly expanded its product sales in consumer electronics (TWS headphones, mobile power supplies, mobile phone accessories, etc.), industrial control, automotive electronics, smart home and other fields. In 2024, the shipment volume of PD power products increased by 90% over the previous year. According to the charging head network, Xinhai Technology's PD fast charging chip is adopted by Samsung, Xiaomi, vivo, Lenovo, Skyworth, Zeekr, Xiaopeng, mophie, Momis, Anker, Shanji, UGREEN and other major domestic and foreign brands.

Jewatt has a rich product portfolio in the field of analog chips, covering more than 40 sub-product lines and nearly 2,200 product models on sale.

The 2024 annual report shows that the company can provide systematic charging IC solutions and mobile power solutions in the field of battery management chips. The company has launched a new generation of Buck-boost charging controller chips, which are used in industrial battery systems, mobile energy storage, mobile power and other fields. In 2024, Jewatt achieved operating income of 1.679 billion yuan, a year-on-year increase of 29.46%.

Nanxin Technology, a fast-charging chip manufacturer, is one of the leading analog and embedded chip design companies in China. As early as 2018, the power bank brand Anker made a strategic investment in Nanxin Technology.

Public information shows that the company has currently mass-produced lithium battery protection chips, which are used in products such as smartphones, mobile power

supplies and smart wearables, and the customer groups it faces continue to expand. Benefiting from the recovery of market demand and the promotion of the company's new

products, in 2024, while the company's wired charging is developing steadily, highly integrated wired charging chips, display power chips, and lithium battery management chips

will be used on a large scale by major domestic customers, and sales will grow rapidly. In 2024, the company's total revenue will be 2.567 billion yuan, a year-on-year increase of 44.19%.

Domestic power bank-related chip manufacturers include Silan Micro, Siyuan Semiconductor (power master control SoC), Yutai (power master control SoC), Guangxin Micro

(protocol chip), Tiandeyu (protocol chip), Baoli Micro (boost and buck chip), Chuangxin Micro (lithium battery/battery protection chip), BYD (lithium battery protection chip),

Yuanxin Semiconductor (boost and buck chip), Silicon Power (boost and buck chip), Lishengmei, Fuman Electronics, etc. Foreign manufacturers include MPS, TI, etc.

03

End Conclusion

After the shock in the power bank market, we expect the industry to return to the emphasis on quality and safety from the price war. Domestic chip manufacturers have been deeply involved in this field for many years, constantly pushing their products towards higher quality and higher safety standards. If you know more about the background of power

bank chip manufacturers, please leave a message in the comment area to share. It is rumored that this type of chip has also become popular in the market recently. Friends who

have relevant news or insights are also welcome to discuss and exchange.